When shaking the Magic-8 Ball yields “Death and Taxes”

Naming the Stable of Problems

The phrase “death and taxes” is often credited to a letter Ben Franklin wrote in 1789. Though it’s been found in earlier texts by other authors, the underlying meaning addresses what can be certain in life. However you define them, the list of certainties is short. As we coach our clients in retirement we set goals together for what we want to happen, make contingency plans for crises we want to avoid, and often look back with hindsight to see all the things we never could have expected to have planned for along the way. Without a crystal ball I am left in the same shoes as Ben Franklin, and so in today’s post we are going to talk about those unavoidable pests: death and taxes.

Specifically:

- The Widow/Widower’s Tax Penalty

- Net Investment Income Tax

- Medicare Income-Related Monthly Adjustment Amounts (IRMAAs)

- Legislative Changes to Tax Code

These four points may come to haunt you in retirement, but making a plan in the present can help address these known risks. Each one is capable of sapping away spending power in retirement by increasing your tax liabilities. Instead of copying and pasting paragraphs of legislative law, I want to share with you the real life impact on a hypothetical retired couple.

Consider Bobby and Sue, a married, retired couple in their early 70s who are collecting Social Security and starting the required minimum distributions (RMDs) that the IRS requires once you turn 72. While working, Bobby and Sue did everything they were told to maximize tax-deferred savings, accumulating a $1,000,000 pre-tax 403(b) from Bobby’s time as a nurse and a $1,000,000 IRA from Sue’s work as an executive. They also invested outside of their work accounts, accumulating an additional $1,000,000 in a brokerage account invested in dividend-paying stocks.

To simplify the example, we can ignore their home and personal assets when calculating their net worth. Focus instead on the income that this household has:

- Bobby and Sue each receive $3,000 per month in Social Security benefits, providing $72,000 of cash flow but only $61,200 of taxable income

- Given their age, they each must withdraw about 3.65% from their pre-tax retirement accounts to satisfy their RMDs, which adds up to $73,000 of taxable income

- Assuming that the taxable account is a conservative buy-and-hold portfolio of dividend stocks that pay qualified dividends (taxed at lower rates), we can expect another $30,000 of dividends each year

All together that is $164,200 of adjusted gross income ($136,400 of taxable income after the standard deduction in 2021), landing Bobby and Sue in the 22% tax bracket.

Let’s call this the Base Case and keep it in mind as we start calling in the four horsemen of retirement taxes.

Known Knowns and Known Unknowns…

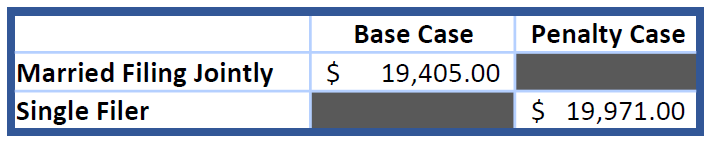

We do not know exactly when we will die, but we know it will happen. When either Bobby or Sue dies the survivor will be taxed at higher rates in multiple ways. Assuming that Bobby passes first, the 403(b) plan is left to Sue; the RMDs continue at the same rate, but the Social Security benefit for Bobby stops. The new household income breaks down into:

- Adjusted gross income: $133,600 (a reduction of 18.6%)

- Taxable income: $119,350 (note that Sue is now in the 24% bracket as a single tax filer)

We can call this the Penalty Case, and it is one of the four horsemen of retirement tax planning. There is no telling when or if your spouse might predecease you, but without planning the likely outcome for retirees with higher income and net worth is more taxes.

Modeling Real Life

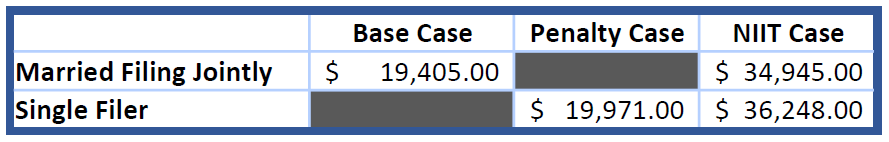

If you are keeping close watch you might point out that I did not include any capital gains in the Base Case or Penalty Case – in any year that the survivor Sue has a meaningful amount of capital gains there are even more taxes to pay. These taxes could also apply in the Base Case with Bobby and Sue, but this next horseman kicks in at a lower income level for a single filer compared to a couple.

Capital gains, interest, dividends, rental & royalty income, non-qualified annuity income, and income from businesses involved in trading are all potentially subject to net investment income tax (NIIT). This tax is triggered when single tax filers have adjusted gross incomes of at least $200,000 (married couples $250,000). The NIIT tax of 3.8% applies to the amount in excess of the trigger.

If we model capital gains of $100,000 in a year after Bobby’s death (we will call this the NIIT Case), Sue will pay $1,277 in NIIT taxes because Sue will have $33,600 of investment income in excess of the $200,000 ceiling for single filers. Sue’s total tax liability is expected to be $36,248; a married couple in the same situation would have only paid $34,945 (none of which is NIIT).

Paying the Fuller Cost of Medicare?

There are close to 64 million individuals insured by Medicare. Using 2022 figures, on average, an individual will pay $170.10 per month for Part B and about $33.77 for a Part D prescription drug plan. What most people do not realize is that the $170.10 is only 25% of the actual cost of Medicare Part B premiums – the other 75% is subsidized and paid by the government (Parts C and D are also subsidized but under a different formula). This next horseman, IRMAA, is a reduction of that subsidy. It can appear in the Base Case and the Penalty Case, but how hard the IRMAA hits depends on the modified adjusted gross income (MAGI) for the taxpayer(s). In Bobby and Sue’s Base Case, they are able to avoid IRMAAs because their MAGI is under the cutoff of $182,000. However, if they have a large sale or an unexpected windfall, the subsidy provided by the government starts to wane, and Bobby and Sue will begin to pay 35% to 85% of the premium for Medicare Part B, depending on the amount of the new income.

If we consider the Penalty Case, this horseman can end up deeper in your pocket. See the chart below for the single filing MAGI tiers and compare them to the joint filing chart above. For survivor Sue, the household MAGI falls to $133,600, but the Medicare costs increase as the subsidy falls to 50%.

Sue’s 2022 Medicare costs will jump from $170.10 per month for Part B to $340.20 per month (twice as much!). Furthermore, there will be a surcharge on Part D requiring Sue to pay an extra $32.10 per month. The IRMAA horseman is out there waiting for unsuspecting retirees to trip into the surcharges – keep in mind that whether you pass the limit by one dollar or a thousand, the result is the same. If you find yourself in a situation where IRMAA threatens, contact Cardinal Retirement Planning, Inc., to discuss if an appeal is right for you.

In addition to the ability to appeal IRMAA charges, know that there is some relief with this horseman that the NIIT horseman lacks; over time the IRMAA levels are adjusted up for inflation. When we have higher inflation levels like after the COVID pandemic & stimulus payments, remember that tax brackets and IRMAA brackets will adjust. The NIIT limits are not indexed for inflation, creating chances for the NIIT horseman to creep into your retirement plans even if your income stays level.

In time, the NIIT limits may change if there is a legislative action that changes the law. That brings us to the final horseman of retirement tax planning – legislative risk!

Tax Law is a Moving Target

As it stands today, the Tax Cut and Jobs Act (“TCJA”) has a “sunset” provision that is one manifestation of the legislative change horseman. This particular provision primarily affects the marginal tax brackets for taxpayers: after being signed into law the TCJA temporarily created the 12%, 22%, 24%, 32%, and 37% brackets, which replaced the 15%, 24%, 28%, 33%, and 39.6% brackets, respectively, while also changing some of the values at each bracket.

What we know now is that the lower tax brackets are set to expire at the end of December 2025. Regardless of any new deals in Congress that could increase or otherwise alter the tax code, we echo Ben Franklin calling out the inevitability of taxes and the impact that death can have on a retirement plan’s tax efficiency.

So what can you do? Plan ahead right now. Taking the time to model and calculate the multiple strategies that your family can use is complex and requires thorough understanding of multiple disciplines (from Medicare & insurance to income tax planning). Partner with a professional who can help you refine model the ways to meet your goals over the short term while also managing the plan for the long term.

Doug “Buddy” Amis, CFP®

MAGI tier tax charts from https://secure.ssa.gov/poms.nsf/lnx/0601101031