Retirement Income Planning & Social Security

Tax-sensitive plans that help you get a check in retirement

Risk-Adjusted and Tax-Sensitive Financial Plans

With a focus on distribution planning, Cardinal Retirement Planning, Inc. can design a comprehensive investment strategy that combines portfolios constructed from academic and quantitative research with detailed financial & tax planning services. Cardinal provides planning for the big picture without losing the details.

Risk mitigation and diversification underpin our series of portfolios. Dr. Michael Aguilar and Dr. Anessa Custovic worked closely with Doug Amis, CFP® to create thousands of robust portfolios that can be matched with clients allowing for deep customization and blending of portfolio return factors. Is your portfolio exposed to more risk than your advisor is measuring?

Whether you are an investor concerned about distributing your wealth over time in a tax-efficient income plan, or you are still in the accumulation phase of your life and need to coordinate multiple types of investments and portfolios, Cardinal’s team can help.

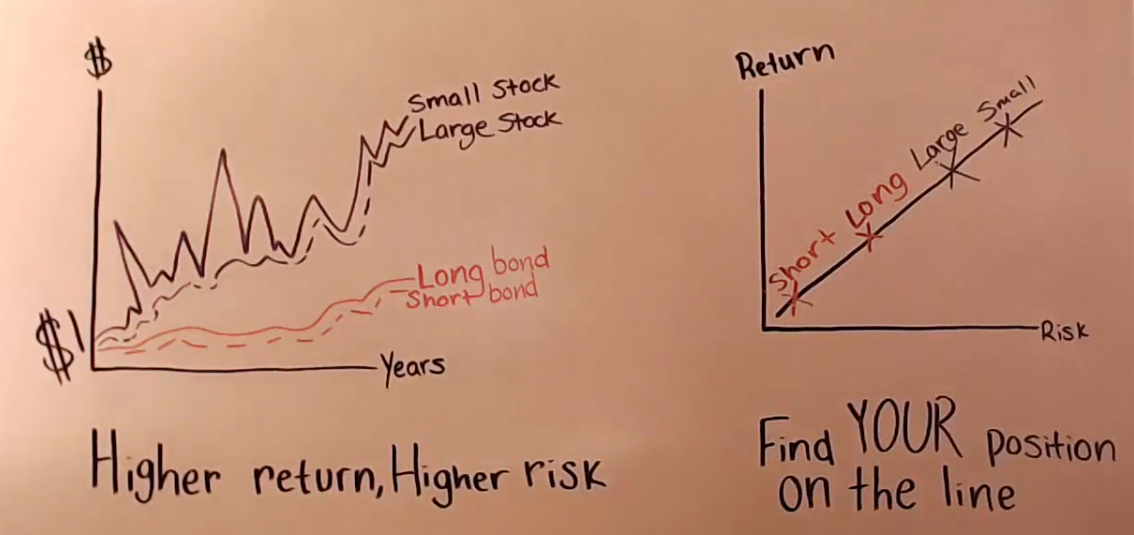

Risk First Approach

Standard deviation is the most common risk measurement you will see when comparing investment returns. From Wall Street to Main Street statistics are used to measure risk because that is what the professionals were taught in school and learned studying Modern Portfolio Theory. Modern Portfolio Theory was built for institutions and businesses looking to limit their risk over a perpetual time horizon, but that is not realistic for a household. Cardinal plans for things like death and taxes, and we focus on risk before returns.

Instead of treating clients like businesses, our advisors match portfolios that are designed to provide robust returns over different time horizons and risk levels to different accounts in a client’s portfolio to truly personalize the investment management process. Our advisors built Cardinal’s investment strategies to be time-sensitive — how long you have to invest matters.

By measuring more than standard deviation, our models and statistical programs are able to detect changes missed by professionals tracking only statistics like standard deviation or volatility. Our team used financial data back to 1900 to understand the true distributions of returns of thousands of assets and we rely on sophisticated sampling methods to perform analysis that goes above and beyond a typical Monte Carlo simulation.

Review Your Risk

Make a PlanCardinal provides initial consultations at no cost or obligation. You get to know us, we get to know you.