Seeking a safer withdrawal rate in the face of severe market and economic downturns

The 4% Rule – But Safer?

This blog is the second part of a series. To read part 1, click here. To read part 3, click here.

If you think of the typical retiree, they have accumulated their retirement nest egg over decades of hard work, sacrifices, and investment ups and down. When retirement starts, the paycheck stops, and if they’re withdrawing during a sell-off or a recession, there is an increasing chance that they will run out of money because of the combination of portfolio size effect and sequence of returns risk, even if they follow the 4% Rule! Essentially, the 4% Rule says you can withdraw 4 percent of your initial portfolio value every year and have a high likelihood of not running out of money during a thirty-year retirement.

Michael Kitces is a prominent financial planner and professional in the retirement industry. His well-known blog has over 50,000 financial “advicers” subscribed. Like Mr. Kitces, we see one of the biggest risks to retirees happening in the first decade surrounding retirement. In his post “The Portfolio Size Effect and Using a Bond Tent to Navigate the Retirement Danger Zone” from 2016, Mr. Kitces shows how the bigger the portfolio, the bigger the “portfolio size effect”. According to Kitces, the danger zone in a retiree’s portfolio happens towards the end of the accumulation phase and at the very start of retirement when you start withdrawing – he identifies the size effect as the culprit. If you don’t know what “portfolio size effect” is or have never heard the phrase “sequence of returns risk,” read this post to learn more from an expert. In summary though, sequence of returns risk is the fact that the order you experience the returns matters much more than the average return over the investment period, and the portfolio size effect explains how a small percentage change in a large portfolio can outweigh a larger percentage change in a small portfolio.

In our previous post we discussed some of the dangers surrounding the popular 4% Rule, and in this post we will focus on Kitces’ “retirement danger zone.” Like before, we will study simulated retirement periods, looking at the probability a retiree will run out of money at different withdrawal rates. This time we made changes to explore the “danger zone” and make our study more realistic. There’s always a chance you retire into a recession, and you won’t know until it happens, so it’s important to explore. So, how is this study going to work?

The Study: Same Kitchen, Different Recipe

We will repeat the same initial steps with a few adjustments around recessions. Unlike before where we used randomized bootstrapped data, we included a severe recession in every one of our portfolio simulations.¹ We also adjusted the length of the simulations. Recall that in the first study we only ran simulations for thirty years; in this study we looked at thirty- and forty-year simulations. This is important to our planning and our clients because life expectancy has been generally increasing for decades.

To be specific, our simulations in the second study covered 100,000 three-year recessions and 100,000 five-year recessions , so we looked at 200,000 timelines with a thirty-year time horizon and another 200,000 timelines with a forty-year horizon. If you’re keeping count, we added another 600,000 simulations to measure the impact of sequence of returns risk.

This study was designed to answer the following questions:

- Do recessions at the start of retirement spell ruin for retirees? What about if recessions are longer than average?

- Does a longer retirement timeline impact success rates?

- What impact does sequence of returns risk have on success rates? If recessions occur later, do they impact retirees as much as an early recession?

Before we jump into the results and analysis of 1,000,000 different simulated retirement lifetimes, I want to remind you of the results from our first study. In that study, we saw there was only a 9 percent chance of a recession at any time during anyone’s retirement. Under those ideal conditions the 4% Rule held up pretty well – but if you are worried about what your retirement plan might look like under less ideal conditions (like a COVID-era retiree needs to), keep reading.

Out of the Frying Pan and Into the Fire…

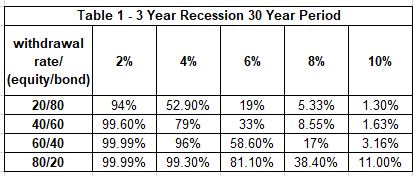

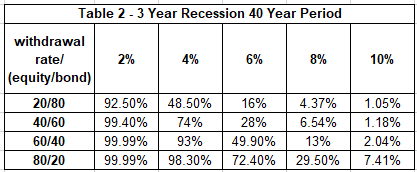

In Tables 1 & 2 below, we have the results for the simulations with a three-year recession at the beginning of every retirement, whether thirty or forty years. They both show success rates of 99.99 percent for investors with a 2 percent withdrawal rate and 80 percent of their portfolios in equities. There’s a slight drop-off in success rates if you have more bonds than equities and maintain the 2 percent withdrawal rate; there’s a steep drop-off in success if you increase your withdrawal rates regardless of the allocation. In each cell you can see that a retiree entering the retirement danger zone during a recession is more likely to run out of money if their retirement horizon is long, even if they follow the 4% Rule.

With what we’ve cooked up so far, it’s beginning to be clear that a three-year recession at the beginning of retirement is a problem, but if we turn up the heat and increase the length of the recession to five years, how much worse are the outcomes?

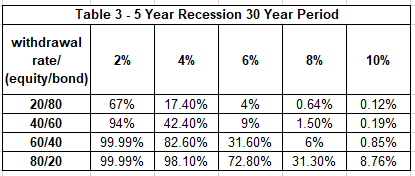

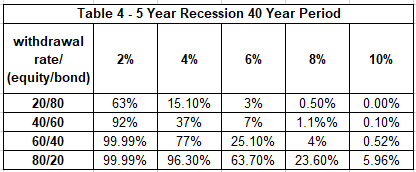

In Tables 3 & 4, we have the results for the simulations with a five-year recession at the beginning of every retirement. When we compare the outcomes in Tables 3 & 4 against 1 & 2, it is absolutely clear that an early and extended recession likely spells ruin for retirees who are breaking the 4% Rule. If you have a portfolio with 40 percent equity or less and follow the 4% Rule, there’s roughly a 60 percent chance you will run out of money within thirty years, and that rises to 63 percent within forty years! Any withdrawal rate higher than 4 percent is almost guaranteed to run out of money. If your withdrawal rate is less than 4 percent you still risk running out of money, especially if you have less than 60 percent equity. At higher equity allocations you have a relatively good chance of success with only a 2 percent withdrawal rate, but this is probably not very realistic, as most retirees are not comfortable with that allocation.

This little experiment tells us that if you retire into a severe recession, you will need to adjust your withdrawal rate or spending plan in retirement so you don’t run out of money. It’s clear that outside of perfect laboratory conditions, the 4% Rule starts to break down. Changing some of the assumptions, like moving from a constant withdrawal rate for your retirement years to a variable withdrawal rate, should improve the success rates for retirees and could better match real-life spending patterns we see with clients.

Is the Coast Clear?

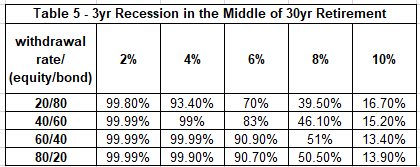

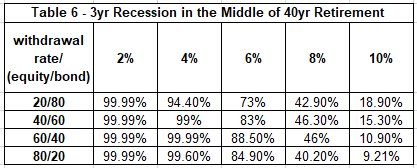

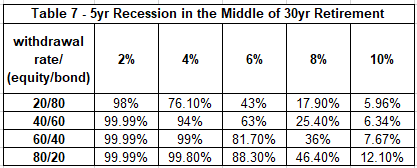

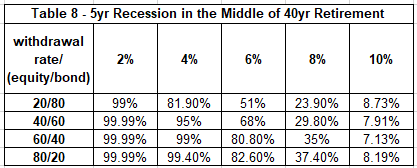

We can say now that recessions at the start of a retirement seriously impact success rates, and outcomes are even worse when we lengthen the time horizon or increase the length of the recession. Recessions can be devastating, but are they as devastating for your economic plan if they happen outside of the danger zone? We’ve modeled and simulated recessions that are in the middle and end of retirement, outside of Kitces’ retirement danger zone.

Overall the success rates we see here for experiencing a recession mid-retirement, in Tables 5-8 above, are in line with the withdrawal research in our first study and Cooley, Hubbard, and Walz’s Trinity study (the original basis of the 4% Rule). The results are undoubtedly worse, but keep in mind we are forcing a recession 100 percent of the time compared to only 9 percent of the time on average.

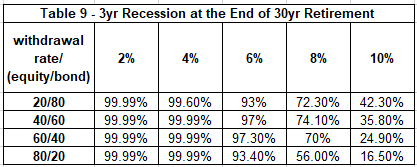

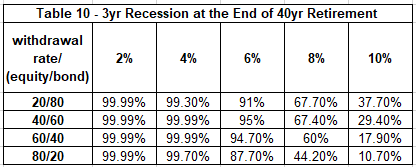

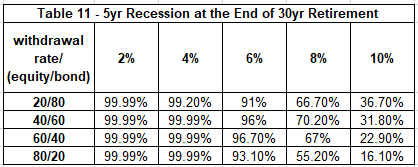

What happens when you have a severe recession at the end of your retirement? Results in that case are shown in Tables 9-12 below. Compared to the Trinity study and our first study, the probabilities are not that far off! The 4% Rule still seems to hold for all allocations if a recession happens at the end of your retirement.

Searching for Safety

So what did we learn? We confirmed that the retirement danger zone Kitces talks about is in fact when the portfolio is extremely vulnerable. Sequence of returns risk is always present, but it’s the hardest to come back from if bad returns happen at the start of retirement when the size effect can work against you. If you get hit with a severe recession in the middle of your retirement, it will still hurt but not as much as the start.

Naturally, you might ask what you can do to mitigate these risks? We can see here that higher-equity portfolios experience higher success rates. In part 3 of this series we will dig deeper into the 4% Rule by exploring alternative withdrawal strategies. These alternative withdrawal strategies can help you better weather market volatility during and after the retirement danger zone.

This study is just one example of why it’s so important to work with a financial planner that understands these risks and can help you mitigate them so that you don’t outlive your money!

1. All data for the comparison study was pulled from Yahoo Finance’s database of historical data, which includes a large number of publicly-listed investments.