Before you can evaluate your returns, you need to understand how they are calculated

What is Total Return?

A common question our clients ask when we review their portfolios is “What should I do with my dividends?” A solid understanding of price return, dividend return, and total return is essential to be an informed investor, as dividends are just one component of total return. My goal is to provide you with the knowledge and resources you need, when you need them, to make informed decisions about your financial plan and portfolio management. To better understand total return and why you may or may not want to receive dividends by holding dividend stocks or other dividend-yielding investments, keep reading for Part 1 of my latest blog series.

To begin: the price return of an asset tells us how much the price of the asset moved over a period of time. The dividend return of an asset is the total amount of dividends paid divided by the price of the asset. The total return of an asset is equal to the price return component of the asset plus the dividend return component of the asset. The formula looks like this:

![]()

Written another way, the same formula shows how the price return component and the dividend return component combine for the total return calculation.

![]()

In regular words this means,

![]()

Breaking Down Total Return with Case Studies

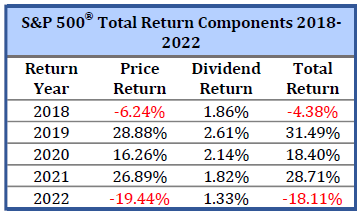

Let’s just look at the past five years of the S&P 500®, breaking the price return, dividend return and total return into separate components. For example, in 2019 there was a dividend return of 2.61 percent, a price return of 28.88 percent, and a total return of 31.49 percent. In 2018, the market had a price loss of 6.24 percent and a dividend return of 1.86 percent, which resulted in a total return of -4.38 percent.

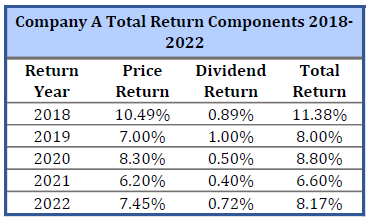

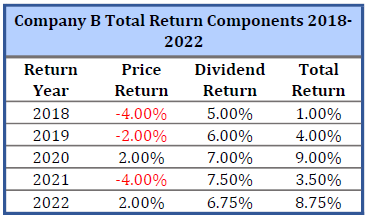

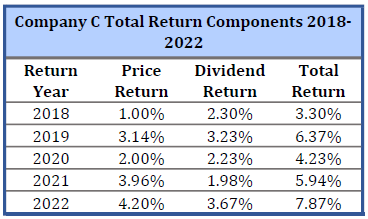

Now let’s make up our own examples to illustrate how just looking at the price return or the dividends you receive can be misleading – you really have to look at the total return to understand what is going on. In this case study I am not suggesting that one investment is better than another but am only illustrating how focusing on a single component of the total return can cause you to miss good investment opportunities.

In the tables above we have two fictional cases. The first, Company A, barely pays out any dividends but has very good price returns. On the other hand, Company B has very high dividends but low price returns. If you were a dividend-motivated investor and only looked at high dividends, you’d likely have chosen to invest in Company B, as it has very attractive dividends. If so, you would have missed out on a higher total return from Company A.

Now let’s introduce Company C. Company C is not a high dividend company when compared to Company B, but it does have above average dividends compared to the S&P 500®. Again, an investor only focused on dividends might be more interested in Company B, but Company C has a higher overall total return due to the better price return and therefore would possibly be the stronger choice.

The Power of Reinvestment

While useful for your overall understanding, one of the problems with looking at the total return of an asset as individual components vs. focusing on the holistic total return is that you might be more likely to see dividends as free money and less likely to reinvest them. Reinvesting dividends means that each time dividends are paid out for a certain asset, you simply use those funds to buy more of the same asset, so your position grows over time. The power of compounding in this case is significant when it comes to total return vs. price return.

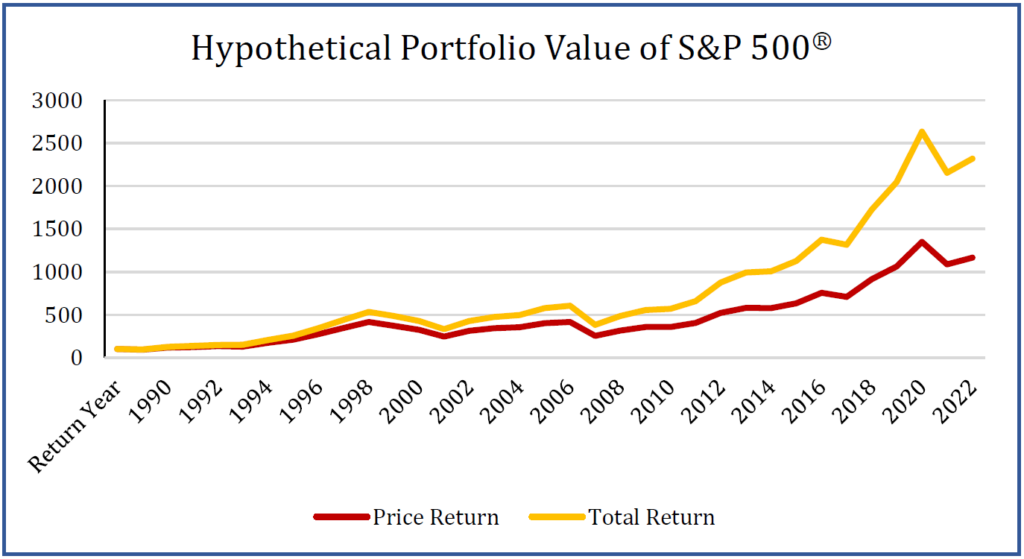

Using S&P 500® data from 1928 to 2022, I calculated what would have happened if you invested $100 in 1927, focusing on the difference in whether or not you reinvested your dividends. If you reinvested your dividends every year, the portfolio end balance would be $750,612.63 compared to only $21,742.10 if you did not reinvest and only had the price return on your portfolio (plus the relatively small cash value of the dividend payments). Now, most of us don’t have a 100-year holding period to work with, so what about more realistic holding periods?

A more realistic holding period might be from 1989 to 2022. The chart below plots the hypothetical portfolio value if you invested $100 in 1989 in the S&P 500®. The yellow line represents a total return (with reinvested dividends every year). The red line is a price-only return, meaning you did not reinvest dividends. The ending balance of the reinvestment approach is $2,317.75, while the ending balance of the price return portfolio is about half that, $1,162.62.

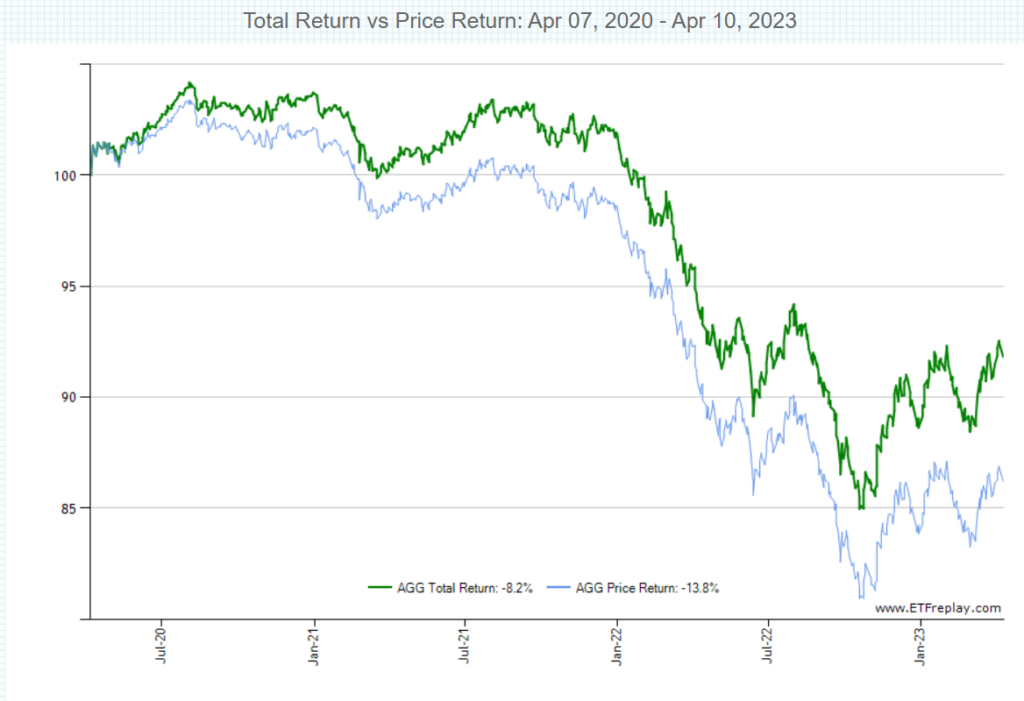

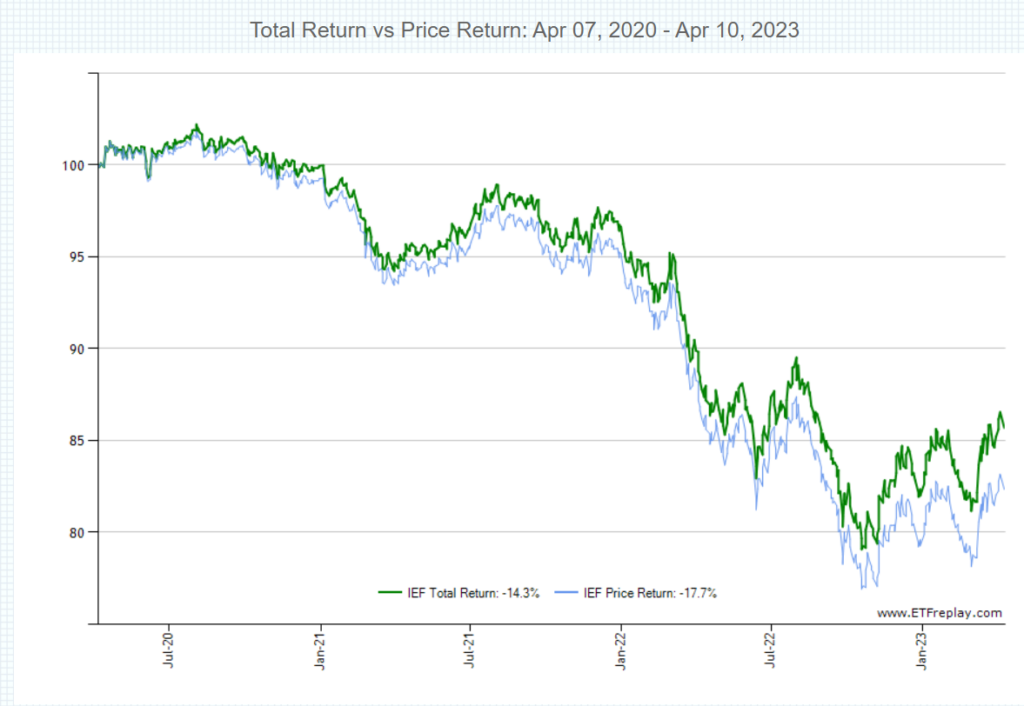

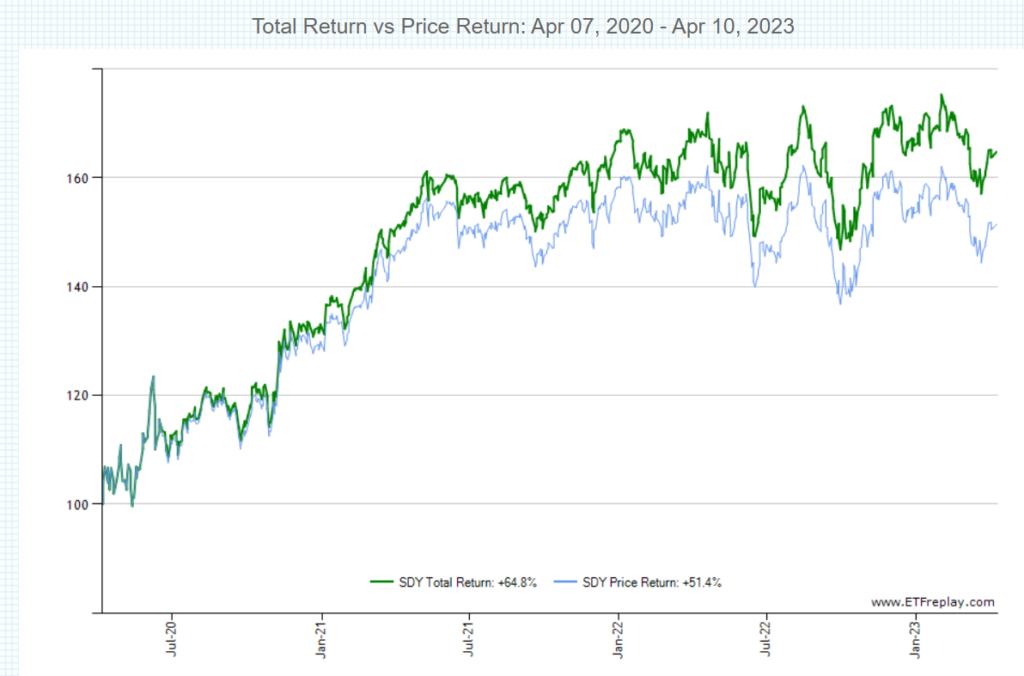

Remember, if an investment pays dividends you will always see a difference in terms of price return and total return, so here are some practical examples that are actually investable. Below you can see the charts (from etfreplay.com) of total return vs. price return from April 2020 to April 2023 for the iShares Core Total US Bond ETF (AGG), the iShares Barclays 7-10 Yr Treasury ETF (IEF), and the SPDR S&P U.S. Dividend Aristocrats ETF (SDY).

These charts show us that even for short holding periods with ETFs you should strongly consider reinvesting your dividends as it has a huge impact on your portfolio.

What is a Good Dividend?

Investors who are seeking dividends are usually looking for high-dividend-paying stocks, ETFs, mutual funds, etc. But what is high? What is low? How do we decide what a good dividend is? If the S&P 500® is the usual benchmark for the equity market as a whole, then it makes sense that a high-dividend payer would have a higher dividend than the S&P 500® and a low-dividend payer would have a lower one. One thing to keep in mind with this type of strategy is that dividends are not constant. Companies do not like to stop paying dividends or make huge adjustments, but it happens. It’s a fact.

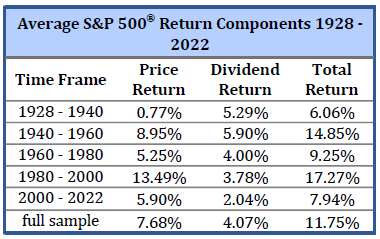

The table below shows us the average price return, the average dividend return and the average total return for the S&P 500® for various time periods. It’s clear that dividends and price fluctuate a lot over time.

There is a place for dividend investing if that is your preference. However, it’s important that you do not focus only on the dividend return and ignore the price return component, as this can really hinder your portfolio growth. Just because a company has a 7 percent dividend return does not mean that is a solid investment, especially if the price return is negative: that means your total return is actually less than the dividend return.

Another big takeaway is that if you are focused on dividend investing, consider the power of reinvesting. Many investors do not reinvest dividends but rather use them as cash flow. Depending on your financial goals, this may not be the best decision to make. You don’t want to miss the forest for the trees. I’ll be writing more about how people make these decisions in Part 2 of this series soon.

Anessa Custovic, PhD