Cardinal’s annual financial market and macroeconomic outlook

Who is Consensus?

Every year large financial institutions from Wall Street release capital market assumptions and outlooks – what they think will happen in the market over the course of the multiple horizons (short term, medium, and long term). Capital market assumptions and outlooks are what guide investing for most financial institutions and individual investors alike. They usually contain forecasts for returns for all different types of assets (e.g. U.S. equity, U.S. treasury bills, real estate, emerging equities, and so on). Taking these estimates from all of the large financial institutions and aggregating them is what we call “consensus” – or, essentially, what most Wall Street analysts expect.

In this post, I comb through a number of outlooks and present Cardinal’s view alongside that of consensus, looking first at the broad global and U.S. macroeconomic outlook then drilling down to the outlook for financial markets.

The Macroeconomic Outlook

With the S&P 500® having been officially in bear market territory, the last year has been rough on markets. Other head winds such as slowing GDP growth and interest rate hikes by central banks (domestic and international) have been weighing on dragging financial markets and the global economy. There is a mix of good and bad news going forward, but the outlook for the U.S. financial market is starting to become more positive, and an increasing number of analysts are revising ten-year capital market assumptions upwards compared to 2021.

At Cardinal, we see global growth slowing with the Eurozone and United Kingdom all but certainly in recession¹. Russia’s invasion of Ukraine continues to weigh on global growth and supply chains, especially in Europe. In Asia, the big story is China reopening, no longer holding to the COVID-zero policy, but there is a looming question whether China can truly go through with this change. Though consumers in China will likely be hesitant to venture out initially, we do view this as being potentially inflationary depending on how strong, how willing and able to spend, the Chinese consumer turns out to be.

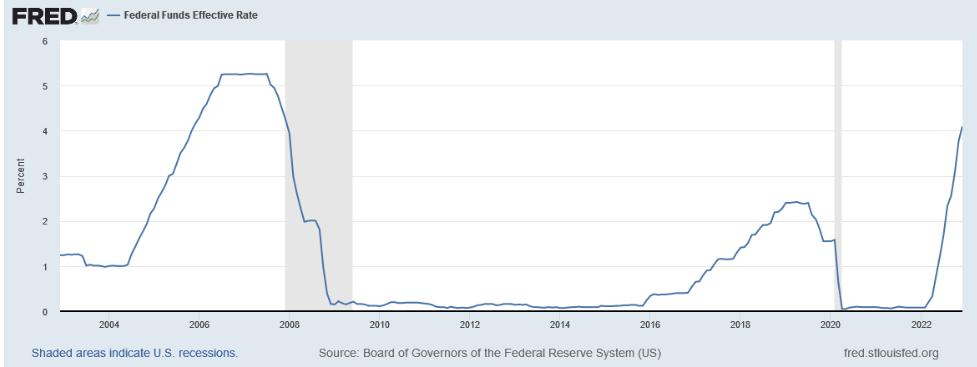

Domestically, we are dealing with a hawkish Federal Reserve, a strong consumer, and a fairly resilient labor market. We do believe that inflation has likely peaked but acknowledge there is much more work to be done, and the possibility of a higher-than-expected Consumer Price Index release in the future remains. Because of this potential risk, we see the Fed likely pausing hikes sometime in 2023 but holding rates high for some time. As you can see in the graph below from FRED², interest rate hikes have been faster than those in the last two rising-rate environments. This has caused a decrease in bond asset prices and affects longer-duration bonds more than shorter-duration bonds.

We are currently experiencing an economic slowdown, which is necessary in order to cool inflation. Economic slowdowns can feel like a recession, but a slowdown does not necessitate a recession. We do not believe that the U.S. will necessarily experience a severe recession. If the U.S. does enter a recession we see it being a shallow recession, with the strong labor market remaining resilient.

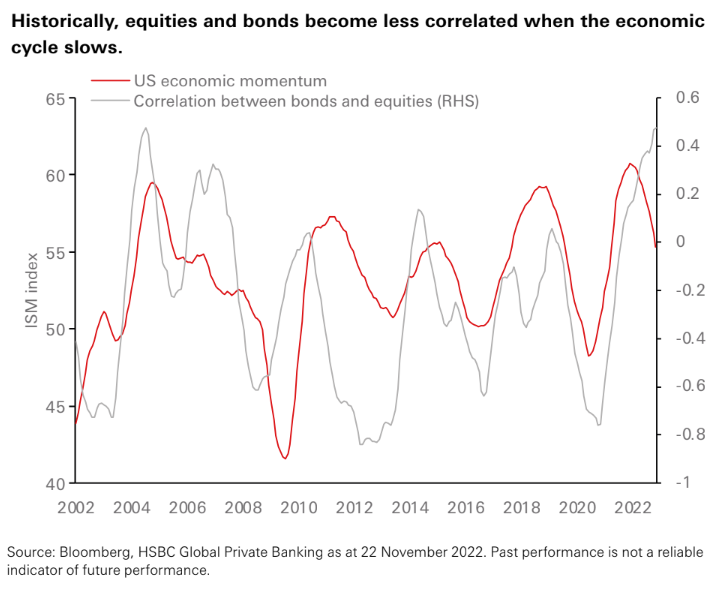

The silver lining of slowing economic growth is that we will likely see equities and fixed income return to historical norms of negative correlation, offering significant diversification advantages for investors. We can see below in the graph from HSBC Bank that as the U.S. economic momentum slows, the correlation between stocks and bonds tend to turn negative. This would help diversify your portfolio risk going forward and would lower portfolio volatility once the correlations turn negative.

Markets Outlook

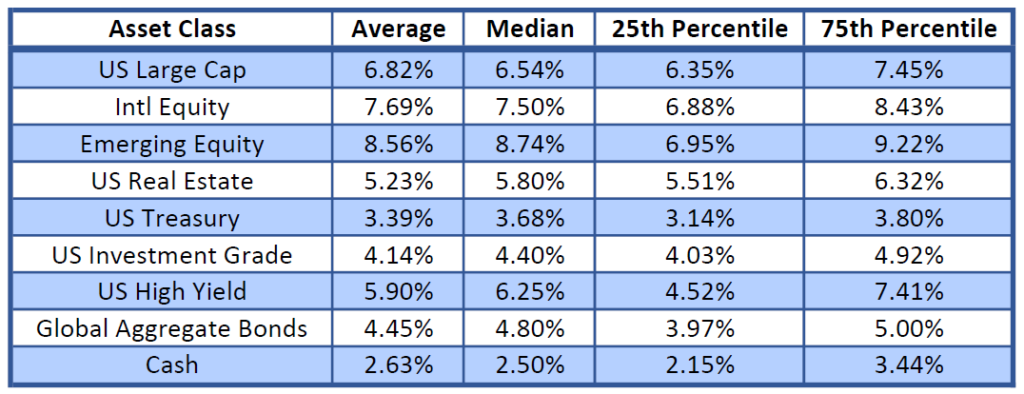

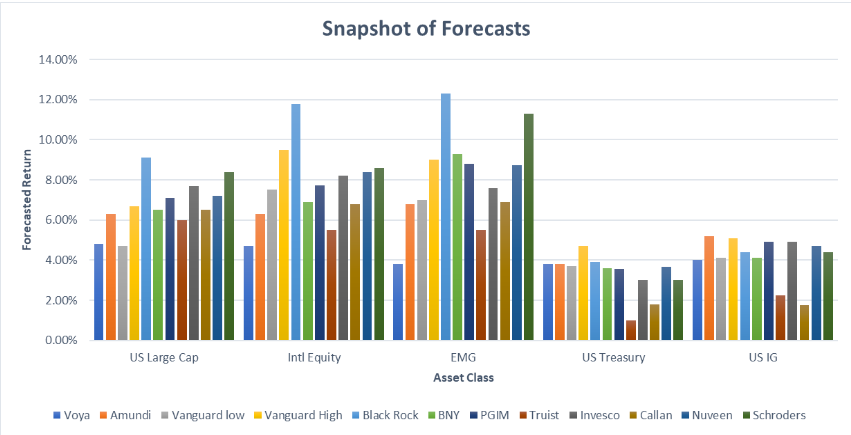

We collected capital market assumptions from over two dozen large financial institutions.³ In the table below we report the forecasted returns: the average across all of those forecasts, the median, the 25th percentile, and the 75th percentile. The following bar graph presents some of the individual forecasts for certain asset classes. The domestic outlook is strong, especially for fixed income which is now becoming more and more attractive.

One thing to note is the range for each asset – there is spread amongst the forecasts. This spread is the uncertainty or disagreement amongst the general consensus. This uncertainty can be explained by differences in assumptions made by the forecasters and differences in the quantitative methodology used to arrive at the forecasts.

Upside and Downside Risks

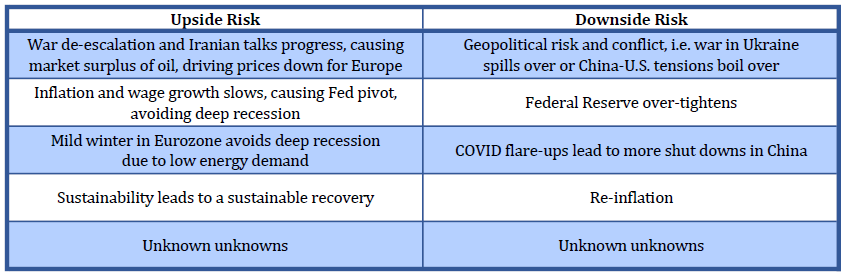

We believe there are a number of potential upsides and downsides on the horizon that could cause macro and market forecasts to be revised upward or downward. The table below summarizes the main risks we see on the horizon. Of course, we include risks from unknown unknowns for both upside and downside potential – just as no one could have anticipated the COVID pandemic of 2020, we must acknowledge that there are risks on the horizon that we will know nothing about until they are realized.

Any of the above coming to fruition does not necessarily mean you should throw out your portfolio or financial plan, but you should think about how it might impact your plan going forward. For instance, if we see more COVID flare-ups leading to more shutdowns in China, this might impact supply chains, causing even more supply constraints, and could be inflationary, causing more problems for the Fed. On the other hand, seeing inflation and wage growth slowing soon with a Fed pivot from a restrictive to accommodative policy would likely be a boon for domestic equity.

These risks, upside and downside, are why diversification is so important when it comes to investing. If you have a well-diversified portfolio, any of the downside risks becoming real should not doom your entire portfolio or financial plan. Similarly, if any of the upsides are realized, you should be able to realize some of those gains in your portfolio due to diversification.

We recommend you re-evaluate your portfolio and your financial plan to make sure you are still on the right track.

Anessa Custovic, PhD

1. The UK recession will be almost as deep as that of Russia, economists predict

2. Federal Reserve Economic Data from the Federal Reserve Bank of St. Louis, one of twelve banks of the Federal Reserve System

3. See full citations here: Bibliography