All work and no play makes Jack a dull boy

From Sea to Shining Sea

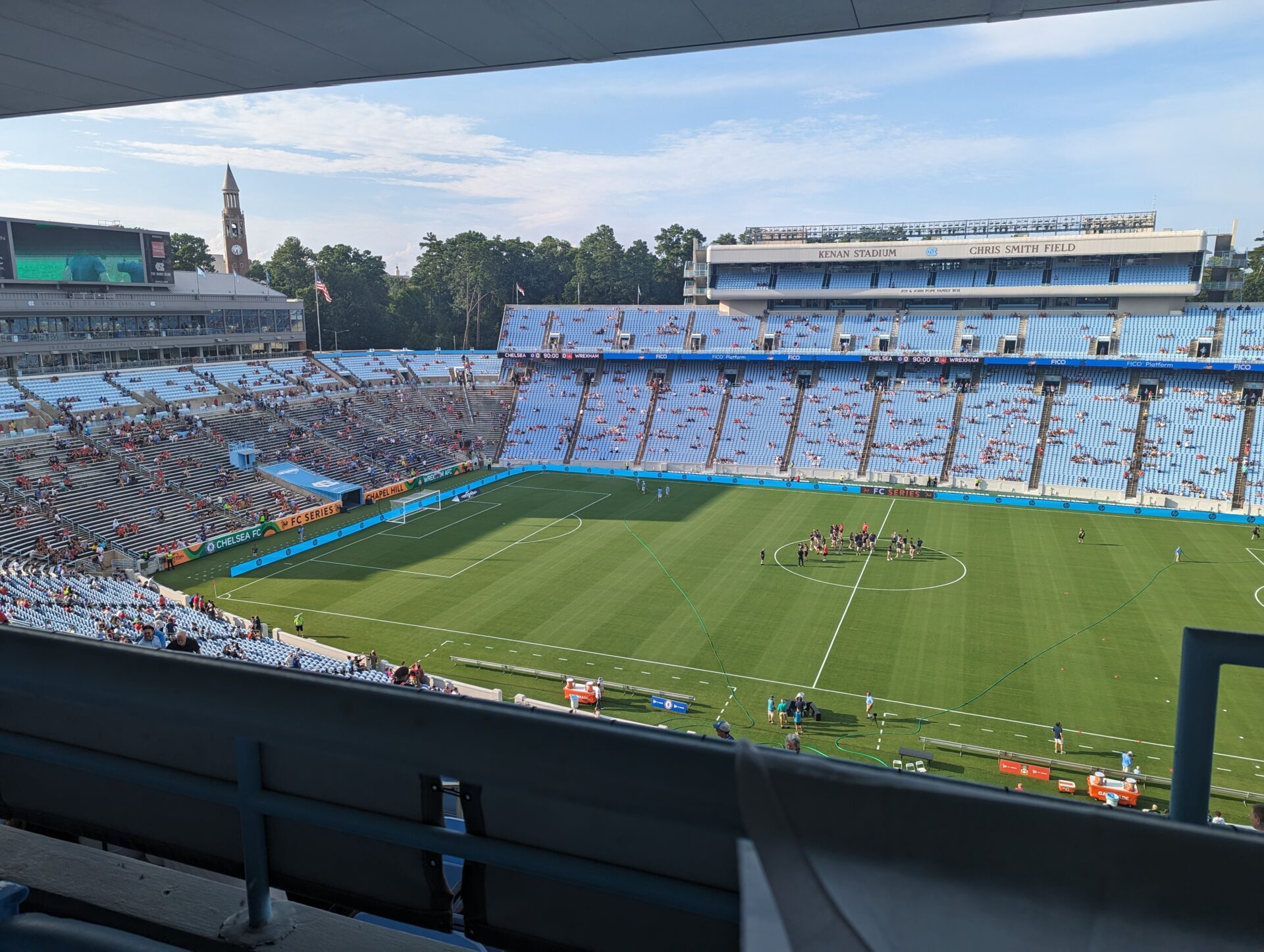

Even as the summer stays hot, advisors here at Cardinal Retirement Planning took the opportunity to see an international friendly game at the Kenan Football Stadium between Chelsea FC and Wrexham FC. You read that right – a real football (a.k.a. “soccer”) game in the UNC Tar Heels’ football stadium! Even if you could not care less about soccer or sports in general, know that taking advantage of a rare opportunity like this is the exact gift we want to give clients like you.

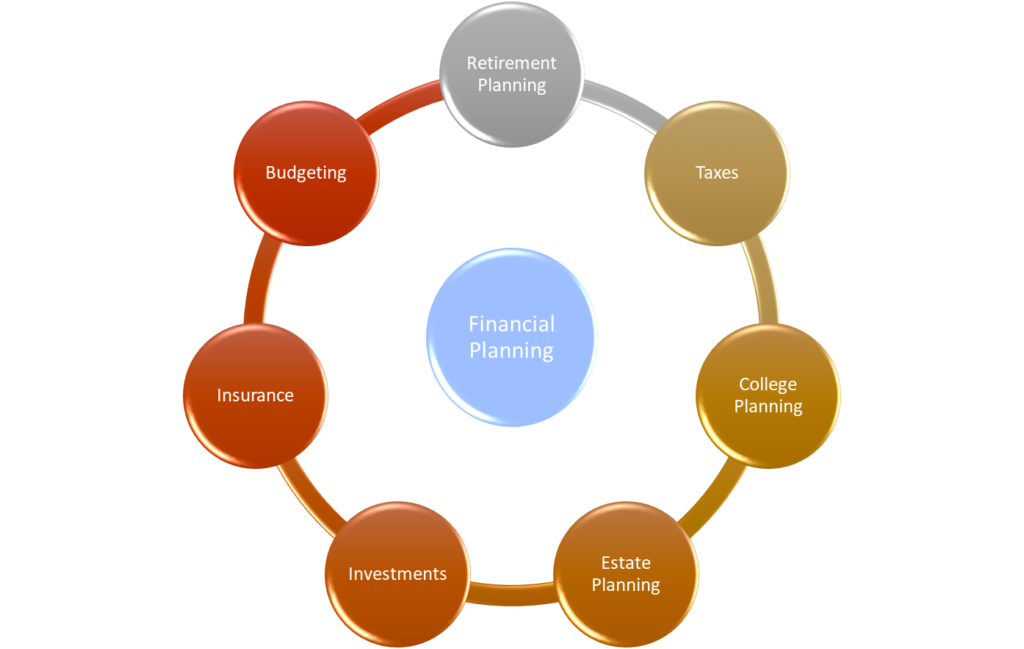

There are a lot of ways to deliver these gifts of opportunity, like through improving financial plans and helping clients & small businesses stride past investment milestones. In this post, I’m going to share with you a deeper look into the ways we helped clients in just one week in July. The specific degree of improvement each service will add to the client’s portfolio or retirement plan will only be known in time, but this peek behind the curtain should help demystify the ways Cardinal can work with you to improve your own cash flow and retirement plans.

The friendly soccer match held in Chapel Hill between Chelsea FC and Wrexham FC sold out in mere days and was expected to bring together over 50,000 people and inject over $15,000,000 dollars to the local economy. That type of success does not happen overnight – I expect it was the product of thousands of hours of labor from hundreds of people local and abroad. Whether or not you orchestrate an international exhibition game or study tax code on the weekends, there are huge opportunities available to those who plan ahead. In my opinion, that is a universal truth. Thankfully, advisors at Cardinal are typically performing for only one or two households at a time (or a few more if we count the next generation(s)), and we need only a few hours of prep per client given our training & experience.

Eight Days a Week

Monday:

While Wrexham and Chelsea players practiced and explored the town of Chapel Hill and surrounding cities, our advisors were delivering presentations to clients as far as 700 miles away on topics ranging from 529 funding goals (and potential tuition assistance) to HVAC tax credits to charitable gifting. We worked with clients both face-to-face and on conference calls.

Tuesday:

Grounds crews at Kenan stadium were hard at work “dialing in” the fresh sod laid for the game. Meanwhile, we held team meetings where we discussed the Treasury yield curve, rollover best practices, and evaluated potential risks to portfolios. Your team here at Cardinal has Certified Financial Planner™ professionals and investment advisor representatives working as fiduciaries with experience and training in tax, law, and estate/trust services.

Wednesday:

In advance of gametime, our advisors kept the momentum going by helping one client review a 1031 real estate transaction spanning 2,400 miles, moving funds from the Pacific to Atlantic coasts and potentially saving tens of thousands in taxes, and for another client increasing interest income by helping them invest “lazy” funds in higher-earning Treasury bills and FDIC bank accounts. Do you know what your bank is paying you (or not paying you)?

Thursday:

The day after a 5-0 blowout in Chelsea’s favor, we continued to help clients interact with their tax professionals, lawyers, and other financial service providers – like playing the role of a midfielder we can be the critical link in an effective professional team.

Friday:

Though this college town quickly reverted back to its usual summer sleepiness, we ended the week in an expansive mood, starting the onboarding of a new client. Think: collecting risk tolerance questionnaires and documents like account statements and trust paperwork to help us get the facts in order and quickly out of the way, so we can spend more time on individual nuance.

Every day:

It is our philosophy that the strategies that add measurable “alpha” (improved returns), like asset allocation, cost-effective implementation, rebalancing, behavioral coaching, asset location, and spending strategies require more than investment management skills. These are strategies that can provide up to, or even more than, a 3 percent improvement in net returns.1 Like practice drills on the soccer field, reviewing these strategies with clients year over year can make a difference because, when it comes to taxes and retirement planning, timing can be everything.

Delivery is Not Guaranteed in 30 Minutes or Less

Delivering real opportunities is a team effort, and we cannot do it without your input. We have helped hundreds of clients retire, but everyone has their own style and needs, so the best way to help us help you is to overshare. Sharing your personality, your goals, your upcoming expenses…all of these details can help us better deliver multifaceted advice drawing on multiple disciplines. Financial planning is a verb; it is a process. We always work hard to demonstrate our value in all fields, from investment management and financial planning to tax and estate law. Doing it well requires reconciling all the hard data (the portfolio facts and figures a.k.a. “the numbers”) alongside the soft data (your wants, desires, goals, and insecurities).

If you have ever heard “an ounce of prevention is worth a pound of the cure” or “the best time to plant a tree is ten years ago; the next best time is now,” you should understand that when I say “planning ahead pays dividends,” I am doing more than making investment puns. The lessons we can learn from these clichés are the same lessons our professional soccer players learn in their practices: success is a product of sacrifice and hard work (and a little good luck can’t hurt!).

The next time you talk with your advisor, remember that we are here to listen & advise, and we take the obligation seriously. We will continue to value the time we spend with clients talking about everything from small talk on puppy care to deep talk on continuing care retirement communities because real life knows no bounds, so your advisor should not either. It is far too common for a small detail to be the key for the door to softly-knocking opportunity. Contact us when you know a sounding board is not enough, and you want practical advice built on a multi-disciplined foundation.

Doug “Buddy” Amis, CFP®