Cardinal’s annual financial market and macroeconomic outlook

The Big Picture: Outlook Overview and Macroeconomic Factors

For our outlook this year, I will discuss the macroeconomic expectations in the short run, then go over the long term and potential risks to these predictions and the implications. Last, I will summarize 2024 industry ten-year Capital Market Assumptions and explain what they mean for you as an investor.

Overall, what I found this year was that a “soft landing” (reduced inflation with minimal negative economic impact) is a very strong possibility, but we will need to monitor the Federal Reserve’s policy for future risks and act accordingly. Clients in or near retirement who already have a long-term plan in place should not need to take much action, but those in earlier or more variable stages of life could need some adjustments.

Going forward, inflation and monetary policy will be two main factors of macroeconomic performance along with global and domestic asset returns. We have seen coordinated monetary tightening globally as a response to the pace of inflation worldwide since the COVID epidemic, and central bankers are not done making adjustments yet. Most appear to be done tightening policy via rate hikes, but now comes the unwinding – when will rate cuts be happening and at what pace? This will be a huge factor in how the global and domestic economies perform over the next ten years.

Short-Term Expectations: Meaningful Slowdown?

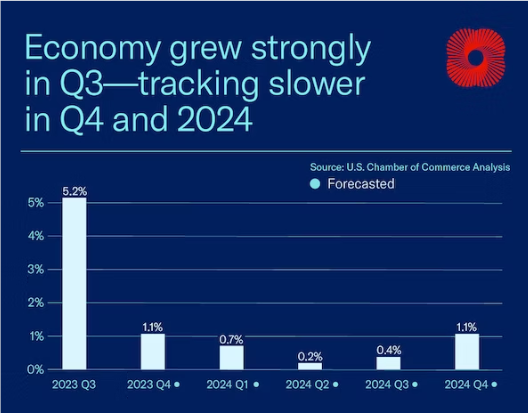

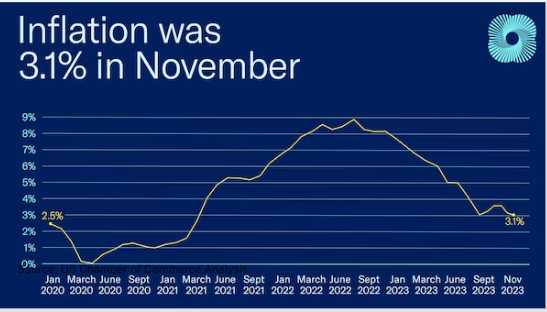

Domestically, we are seeing meaningful slowdowns in GDP and inflation in response to the Federal Reserve’s actions. These slowdowns are a reflection of monetary policy tools performing as intended.

Looking at this chart (above) from the US Chamber of Commerce Analysis, we can see that the US economy is still projected to grow over the short term, just more slowly compared to when the economy was running too hot. During that time, following the pandemic, we saw a huge spike in inflation, squeezing the consumer. The chart below, also from the US Chamber of Commerce Analysis, shows that inflation is coming down from a peak of almost 9 percent!

This is what I and other economists mean when we say “things are functioning as intended” because inflation is continuing to decrease. We are not back at the 2 percent rate everyone would love to see again, but this is a sharp decrease from where we were and well on the way to where we would like to be. It is important to note that despite potentially meaningful slowdowns in inflation, the US labor market remains strong and resilient. This is why many economists are wondering if this is in fact the soft landing we were all hoping for. Overall the outlook for the US economy is optimistic, but there are risks on the horizon we cannot ignore that could still turn our soft landing into a hard landing.

Risks on the Horizon

There are always a number of risks to our domestic and global economic growth. Here I highlight what we feel are the main or most noteworthy risks in the present moment.

Geopolitical Risk:

There are numerous international conflicts currently playing out (e.g., Russia’s invasion of Ukraine and the Israel/Palestine conflict), and there is no clear end in sight for most. There does still remain the chance, however small it may be, that geopolitical tensions could continue to heat up and spill over, in which case we feel that the international and emerging markets would be impacted more than domestic equity markets.

Monetary Policy:

Given that monetary policy works with lags, there is always a risk that the Federal Reserve (or other central banks globally) have gone too far with tightening monetary policy or have not gone far enough. Since the Great Financial Crisis up until the COVID pandemic we lived in a world with ultra loose monetary policy and extremely cheap money. Now we are returning to a more historically normal time where there is some inflation, and borrowing costs are higher than they were for the past fifteen years or so.

Election Uncertainty in the US:

The presidential election (along with many congressional elections) are taking place in November of 2024. Depending on how the election shakes out this could have a big impact on how the economy and markets perform going forward.

Worsening Climate Situation:

The ongoing climate crisis has already had measurable negative economic impacts. If it gets worse and we experience more frequent and more destructive weather disasters, this could severely impact the supply chain.

Capital Market Assumptions

Capital Market Assumptions (CMAs) are put out annually by large Wall Street banks and countless other independent financial institutions. CMAs usually consist of long-term (five- or ten-year) expected returns for the large, well-known asset classes, such as large-cap equity and international bonds, and are used in investment decisions and portfolio positioning. When the finance industry first started coming out with CMAs in the early 1900s, they were mainly based on historical data. Investment banks and researchers would collect all the historical data they could find and take averages, medians, and other measurements to construct the future outlook. This type of method assumes that historical performance drives future performance. This is neither totally true nor totally wrong. While historical performance can certainly drive future performance, it is not the most accurate way to forecast asset class returns.

Since the start of CMAs, consensus has moved from historical calculations to more forward-looking complex quantitative techniques. Academics and practitioners alike have put forth a breadth of different forward-looking indices and quantitative modeling frameworks. Most institutions that are releasing their own CMAs are using proprietary data and quantitative frameworks to come up with their outlooks. At Cardinal, we gather all the CMAs we can, combine them, and then add a bit of a discretionary overlay.

Our Take on the Consensus Outlook

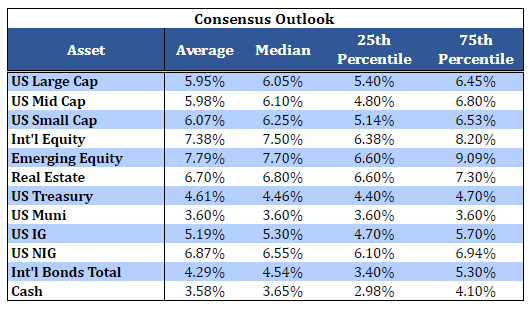

Using outlooks from Amundi, AQR, BlackRock, BNY, Fiducent, Morningstar, Northern Trust, Riverfront Investments, Schwab, State Street, Vanguard, Versus, and Voya, I consolidated the consensus outlook for various asset classes into the table below.¹

The good news is that fixed income is now projected to have meaningful returns, as opposed to the past ten to fifteen years where equity was mainly driving portfolio returns. In addition to the improved fixed income outlook overall, it is likely we will see more diversification benefits from fixed income than we have in the past ten to fifteen years as well – another boon for investors. Equity outlook has been revised downward a bit compared to outlooks from the past two to three years, but that is to be expected given macroeconomic conditions and the Federal Reserve’s monetary tightening post-COVID. I see this as a positive tradeoff for investors, primarily those focused on retirement: bonds will now provide healthy returns, meaning you would not have to take additional equity risk to realize a target return.

While the consensus outlook is positive for international and emerging markets, as evidenced by the projected higher returns than US domestic, we cannot ignore the risks associated with investing internationally. Geopolitical tensions could heat up and spill over, in which case we feel that the international and emerging markets will be impacted more than domestic equity markets. Taking geopolitical risks out of the equation, there is inherently higher volatility in emerging markets and some international markets than you will find in domestic US equity markets. This is why we still have a higher preference for US equity exposure.

One important thing I would like to point out is the outlook for cash. The consensus average return for cash is about 3.58 percent, with the 25th percentile at 2.98 percent. This means that virtually no one is forecasting a zero Federal Funds rate (the rate at which banks borrow from each other) over the next ten years, but rather are predicting a healthy return on holding cash. I am in agreement with the consensus here, I do not see cash falling below 2-2.5 percent over the next ten years. However, this is not to say it is impossible we would see a zero Federal Funds rate, which would likely cause cash returns to similarly drop, it is just extremely unlikely. We would need some sort of Great Financial Crisis or COVID-style event to induce such rates again.

Depending on where you are in your life, you may want to reposition your portfolio. The forecasted lower Federal Funds rates may also offer opportunities to refinance high-interest-rate debt. Overall, we are moving towards a lower inflation environment that should benefit the investor and consumer alike. Contact your financial advisor at Cardinal if you need help adjusting your portfolio or financial plan or have further questions.

Anessa Custovic, PhD

1. See full citations here: Bibliography