Why does my advisor keep telling me to stay in the market?

Compound Interest: A Bedtime Story

Missing even a few of the best days over an investor’s time horizon will substantially lower the returns. Barring being able to see the future, an investment advisor’s best tools to materially improve an investor’s return are behavioral finance and the power of compound interest. Speaking for all investment advisors, we can’t control the market; speaking broadly again, timing the market is a fool’s errand: the majority of active managers underperform their benchmark. That doesn’t mean an advisor is unable to help you.

Let’s start with highlighting the power of compound interest as one of the tools in the advisor’s toolbox. The example I’m going to use has been passed down for generations, with the first record of this story coming from the year 1256¹:

The Indian King Shirham asks Grand Vizier Sissa ben Dhair what reward he desired for inventing the game of chess.

Sissa responds: “Majesty, I would be happy if you were to give me a grain of wheat to place on the first square of the chessboard, and two grains of wheat to place on the second square, four grains on the third, eight grains of wheat to place on the fourth, and so on for the sixty-four squares.”

“And is that all you wish, Sissa, you fool?” the astonished King asked.

Picture a chessboard with its 64 squares. Sissa is asking for one grain of wheat, compounded at 100% interest over 64 periods. By the time we get to the fourth square, Sissa’s request has grown to a total of 15 grains (1 grain + 2 grains + 4 grains + 8 grains). Not even enough for a meal, but let’s see where we end up after another four squares.

- 8 doubles to 16, plus the original 15 grains = 31 grains in total

- 16 doubles to 32, plus the previous 31 = 63 grains in total

- 32 doubles to 64, plus the previous 63 = 127 grains in total

- 64 doubles to 128, plus the previous 127 = 255 grains in total

Not quite a heap of wheat yet, but with another four squares…

- 128 doubles to 256, plus the previous 255 = 511 grains in total

- 256 doubles to 512, plus the previous 511 = 1,023 grains in total

- 512 doubles to 1,024, plus the previous 1,023 = 2,047 grains in total

- 1,024 doubles to 2,048, plus the previous 2,047 = 4,095 grains in total

By the thirteenth square the wheat would be a heap with 8,191 total grains.

At the twentieth square we’re crossing a million. At the twenty-seventh we’re over 134 million. Crossing the billion mark only takes another three squares and there are still 34 more squares to go (we’re not even half-way yet!).

Adding up all the grains of wheat that Sissa has requested would total 18,446,744,073,709,600,000 grains, or over 18 quintillion grains.

Putting Theory into Practice

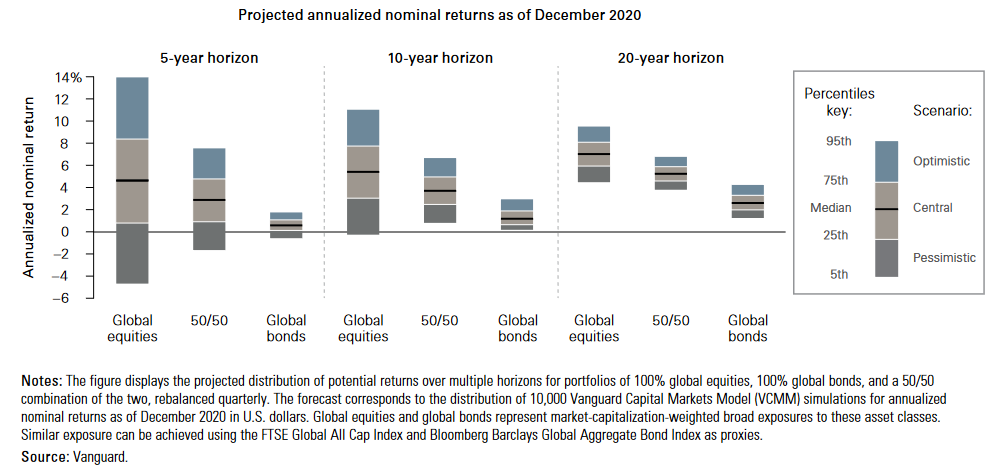

Like the grains of wheat on a chessboard, investment returns compound over time. By no means am I arguing that an investor should expect 100% compound interest for any investment, but even at lower rates of return the figures add up. Consider these historical model portfolios from Vanguard, where they measure the average annual rate of return over 95 years of history. Using the 20% stock, 80% bond portfolio as a conservative example and the 100% stock portfolio as an aggressive example, the average annual returns fall between 7.2% and 10.3%.

At these rates, an investor with $100,000 who relies on compound interest can expect to have between $200,000 and $266,000 after ten years. By the end of the twentieth year, the portfolio will have grown to $400,000 and $710,000 for the conservative and aggressive portfolios, respectively. The true difference between Sissa’s reward and this example is bigger than the numbers – an investor has to be patient for years to receive their reward, and there’s no guarantee of positive returns from a grateful King Shirham. But investors should know this: holding investments for long periods helps improve the odds of higher returns. When advisors encourage investors to stay invested in the market during a sell-off, we’re looking to the power of compound interest and its power over time.

In the study above from Vanguard, the likelihood of having overall negative returns over a 10- and 20-year horizon is significantly less than the 5-year horizon. What this means in practicality is that all investors are likely to face negative returns at some point, but staying invested in the market and allowing your portfolio the chance to recover is the wiser move compared to selling and walking away. Missing even a few of the best days over a long time horizon is costly (see this Learning Center post for more information) because of the missed opportunities to compound even small investment gains over a period of time.

Easy to Say, But…

How can an investor develop the resolve to stay invested?

This is where behavioral finance and financial planning come into play. To achieve the long-term investment horizon, an investor needs to first establish and prioritize their goals while charting a safe course through an uncertain future. There are different types of goals, and each investor may rank the same goal differently, but generally financial planners will recommend having sufficient cash or savings to cover your basic living expenses and an emergency fund for contingencies.

Planning to invest assets that aren’t needed for day-to-day expenses and contingencies is necessary to building wealth. Having a diversified portfolio is more than investment asset allocation. I and other planners strongly recommend categorizing your assets and resources into three distinct categories:

- Guaranteed income: pension income, Social Security income, or payments from an income annuity. Income serves as a foundation to a well-built retirement plan.

- Liquid assets: brokerage accounts and retirement plans invested in publicly-traded stocks and bonds that can be sold quickly and at a fair price. Evaluating the different types of investment strategies and their expected risk & return will help an investor pick the right portfolio.

- Additional resources: assets like your home & its equity, your human capital & earnings ability, and insurance.

Working with your investment advisor & financial planner to better understand your retirement plan’s risk capacity is key to staying in the market. Without an understanding of your goals and priorities, a market correction or sell-off could force an emotional reaction, leading you to sell your liquid assets and miss the power of compound interest. The best financial plans are designed to use all three categories to help build a mental framework to withstand market storms and stay invested.

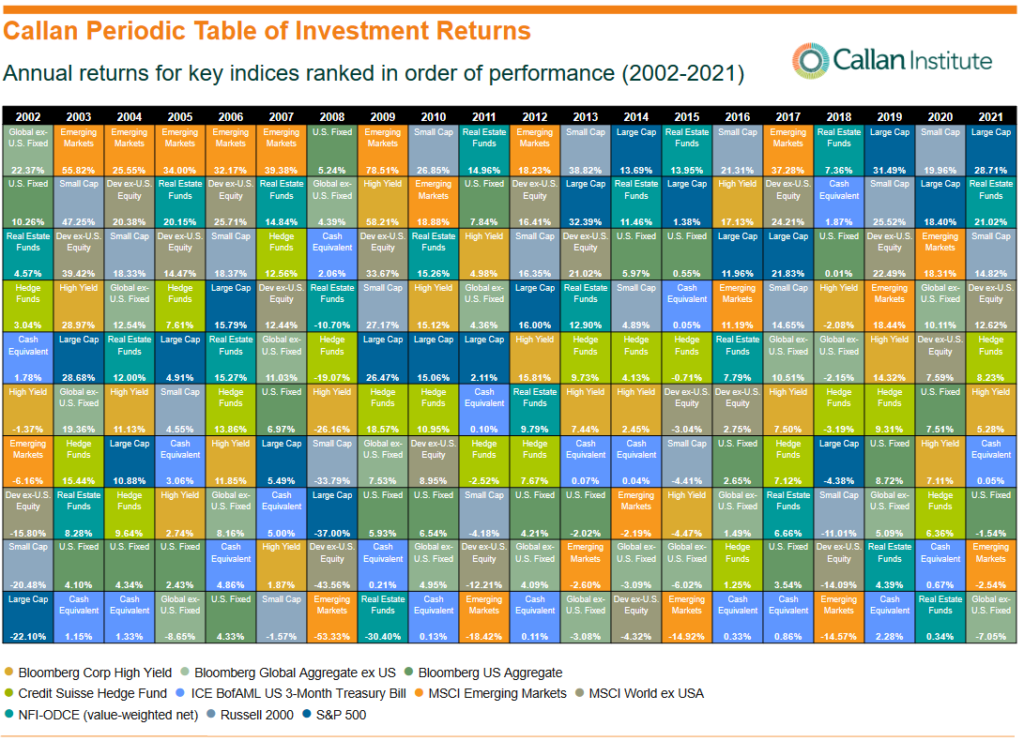

Markets rarely move in straight lines, and despite historical average annual rates of return over the long run being 6% or more, there are months, quarters, and even years where an investor’s portfolio might show a loss. This is part of investing and is not a reason to quit. During these times I like to refer to this Periodic Table of Investment Returns study from Callan Institute as a reminder that a well-constructed, diversified portfolio will have some winners and losers no matter the market.

Our Benchmark+ portfolios are designed to weather the long-term ebbs and flows of the market. They are designed with multiple investment horizons, low turnover, and diversification. Each portfolio can be customized for each client with overlays to enhance tax efficiency, dividend income, ESG holdings, or international diversification. Contact Cardinal Retirement Planning to start building your own Benchmark+ and your long-term financial plan!

Doug “Buddy” Amis, CFP®, CLU®

¹Ibn Khallikan’s Biographical Dictionary Vol.3 (1814), p.71-72

Vanguard’s roadmap to financial security: A framework for decision-making in retirement, Section 1: Determine retirement goals