Planning for long-term care is difficult, but not nearly as difficult as not having a plan.

The Hard Truth

The holidays are just around the corner! Thanksgiving Day football, Black Friday shopping (maybe on Amazon if you’re like me and want to avoid the crowds), and…talking about long-term care planning with your family? One of these things is not like the others, but it’s also arguably the most important conversation you can have with your family this year. Sit back and hold onto your seats, folks, because I’m about to throw some numbers out there that may just knock your socks off.

- 69 – Percent of people turning sixty-five today expected to need any form of long-term care services in their lifetime, according to the US Administration for Community Living (ACL)

- 35 – Percent of people turning sixty-five today expected to need care in a nursing facility in their lifetime, according to ACL

- 20 – Percent of people turning sixty-five today expected to need care for longer than five years, according to ACL

- 7.5 – Estimated number of Americans (in millions) who have some form of long-term care insurance as of January 1st, 2020, according to the American Association for Long-Term Care Insurance (AALTCI)

- 330 – Estimated U.S. population (in millions) as of January 1st, 2020, according to census.gov

I’m a numbers guy myself, so when I first read those statistics, I was absolutely floored. I talk about long-term care planning with clients often, and the crux of the conversation is usually long-term care insurance. You’ve probably heard or read about it before, but it’s a form of health insurance that is designed to pay if and when you need long-term care services.

In my CFP® certification training, one thing we always came back to was that if a risk has a high probability of happening and a high expense, we should look to insure it. So if the risk of needing long-term care is likely and the expense is so large, why are so few people insuring against the problem? Today we’re going to talk about some of the common roadblocks that I’ve seen in my time in the industry.

Roadblock #1: The Cost

Arguably the biggest roadblock clients face when looking to insure against the risk of needing long-term health care is the cost. Long-term care services are expensive, but the insurance isn’t cheap either. Let’s take a look at an example of a policy that a couple might consider when going down this rabbit hole:

| Male | Female | |

|---|---|---|

| Age | 65 | 65 |

| Benefit | $4,500/month | $4,500/month |

| Duration | 3 Years | 3 Years |

| Inflation Protection | 3% Compound | 3% Compound |

| Premium | $3,022.93/year | $5,057.35/year |

As shown above, to insure a couple at age sixty-five, you may be looking at spending over $8,000 per year. That number alone can cause sticker shock for many clients who are unfamiliar with the long-term care insurance ballgame, but so can $7,604 per month, which was the median cost of a private nursing home room in 2021 in Raleigh, NC. The average length of stay in a nursing home is 2.6 years for a female and 2.3 years for a male. If we do a bit of math, we’re looking at about $237,000 worth of medical expenses for care for the average female stay in a nursing home. An average-to-extended stay in a nursing facility can devastate the unprepared family’s finances.

Long-term care insurance is undoubtedly expensive, but there’s a reason: There is a high likelihood that you will need care and need it for an extended period of time, and if you do, then the premiums you pay can end up feeling like pennies on the dollar compared to the benefit you receive.

Roadblock #2: Why Now?

You’ll notice I picked age sixty-five for my example above, and no, that wasn’t an arbitrary number. Early- to mid-sixties is when we often see clients really buckle down and start talking about long-term care. I think this is because it’s a natural point of conversation when you’re starting to gear up for Medicare, considering your options, and learning about what Medicare covers (and what it doesn’t).

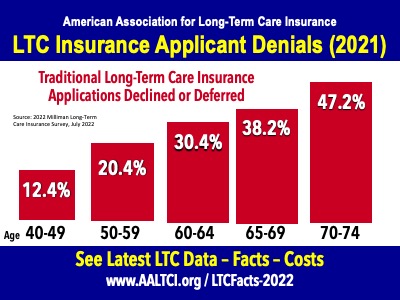

In these conversations, a common roadblock I’ve run into is the temptation of waiting, of trying to find the perfect time to bite the bullet and buy the insurance. Clients wonder, “Why not wait until I’m in my early seventies, or better yet late seventies, and buy it then? That way I’ll only have to pay premiums for a few years before I need the coverage.”

While that may sound attractive on paper, the sad truth is that the longer you wait to apply, the less likely that you will be accepted for the insurance, as you can see in the graphic below from AALTCI. Even if you’re accepted, the premium that you will pay will be substantially higher. For example, that same policy referenced above would cost almost $6,500 per year for a seventy-year-old woman and almost $9,500 annually for the same woman at age seventy-five.

If the longer you wait the more likely it is that you will be declined, should you run out and buy insurance today? When is the right time? Well, if you’ve worked with myself or my team here at Cardinal, stop me if you’ve heard this one before: It depends.

While some companies will offer long-term care insurance as early as age thirty, for most people that is too early to look into it. There are other risks that will likely take a higher spot on your priority totem pole, like disability or early death. We have seen that usually the “sweet spot” is in your late fifties and early sixties, where the rate of acceptance is still fairly high, and ideally you’re in your prime earning years at work and approaching retirement.

Roadblock #3: Use It or Lose it?

The third major roadblock I’ve run into with many clients is that if they don’t use the insurance, then they’ll have spent all of that money for nothing. If we look back to twenty years ago, this concern was so common that the industry actually created hybrid long-term care policies to attempt to address the issue. When I think of hybrids, the word “bundle” comes to mind. Similar to how cable television, internet, and phone service are commonly sold, hybrid policies are “bundles” that take a life insurance policy or annuity contract as the base and add on long-term care benefits. Because the policy is built with a death benefit, it eliminates the “use it or lose it” nature that is traditionally associated with long-term care insurance.

I believe hybrids are a great tool to have in the tool box for certain planning situations. Clients with a legacy goal may find value in having the death benefit if they don’t use the money for care. They also tend to be easier to qualify for than traditional long-term care insurance.

That said, I don’t think they’re the greatest thing since sliced bread. Having the death benefit can be nice, but it also causes the policies to be significantly more expensive than traditional policies. The policies usually have very low rates of return if you need care, especially when compared to traditional policies that can return well over 10 percent in the same scenario. While I find value in hybrid policies, I usually find myself recommending traditional insurance because of these two reasons.

Traditional long-term care policies may have the risk of not getting any tangible benefit from the insurance, but they provide value regardless of if you need care or not. Think of traditional policies just like you think of car insurance or homeowner’s insurance; you hope you never need to use them, but you sleep much better at night knowing that if something does happen, then your family is protected. Ideally you live a long life, never need care, and pass away at a ripe old age in your sleep. However, if things don’t quite work out like that, you know your family isn’t going to have to think twice about the financial side of things before getting you the help that you and they need.

Roadblock #4: The Budget

Earlier, I said that the “sweet spot” of when to purchase long-term care insurance was usually in the late fifties or early sixties as you’re approaching retirement. If you’re a budgeter like me, you probably noticed I’m asking you to take on an extra $8,000 annual expense in retirement, when your income is likely dropping from what you’ve been accustomed to in your prime income working years! That’s a large budget item to add on as you approach your fixed-income stage of life. In fact, it may be an increase of anywhere from 10-20 percent in your annual expenses, depending on your budget in retirement.

That’s why I strongly recommend working with a fiduciary on creating an overall financial plan that is centered around funding not only your lifestyle but also things like long-term care insurance that will help your family maintain their lifestyles if push comes to shove. I don’t think about long-term care insurance as a burden; I think that it’s freeing. It’s freeing to know that you can live your next twenty to thirty years in retirement without worrying about how your family will pay for care if you need it.

If your family needs to have a tough conversation this Thanksgiving, know that you don’t have to do it alone. Work with a fiduciary like myself at Cardinal Retirement Planning, Inc., and we will help you create a plan that will work for you both today and for the years to come.

Jacob Yocco, CFP®