What’s the Latest Return on the NASDAQ, Dow, or S&P?

Open any financial news app, and you have the answer at your fingertips. Here’s a more relevant question: What’s the return on a 60/40 stock/bond benchmark portfolio that an investor has held for the last year with dividends and coupons distributed instead of reinvested? No matter how much you swipe on that app, you’re not going to find the answer easily.

Investors cannot invest directly in an index, they need to buy the portfolio that mimics the index or invest actively. Necessary decisions around when to buy/sell, and whether to send dividends & interest to a checking account or reinvest them must be made by retirees and investors.

In our blog we document and explore various aspects of the risk and return profile of key benchmark portfolios. After all, not having a benchmark is like trying to measure without having a yardstick.

In this post, we focus on the historical performance of stock / bond returns.

How Do We Make a Good Stock/Bond Portfolio for a Benchmark?

The main ingredients are the S&P 500¹ and 10-year Treasury². Mix them together to generate the ubiquitous 60/40, or any other flavor. It might seem simple, but there are other vital parts of the recipe that shouldn’t be overlooked.

First, what is your holding period? Let’s say it is one year. Computing stock returns is simple: capital gains over the holding period + dividends earned. Computing bond returns, however, is not. There is a maturity mismatch. When selling the 10-year bond after 1-year, price risk looms over your potential returns. The price of the 10-year bond will fluctuate as the interest rate changes (rising as rates fall and vice versa), implying that we need to adjust our return series.

Second, what is your investment period? Did you buy in 1981, 1991, or 2001? We need to explore various holding periods through time.

Third, what is the risk of your benchmark? Focusing on returns is only half of the story.

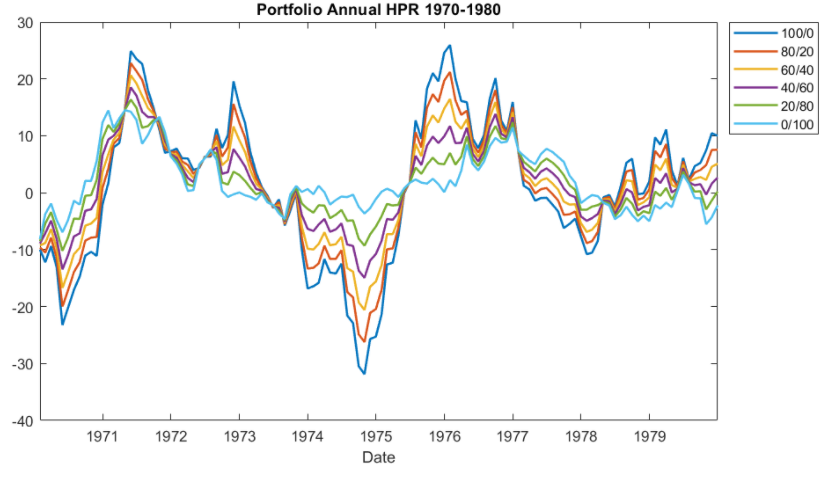

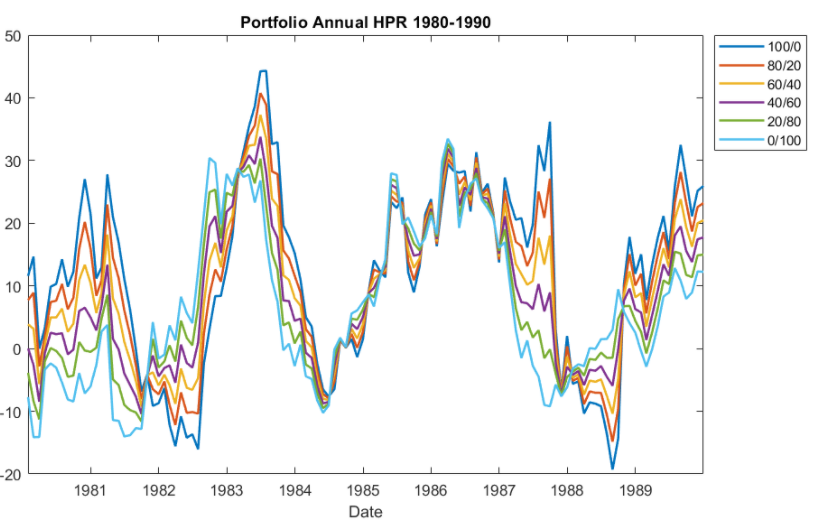

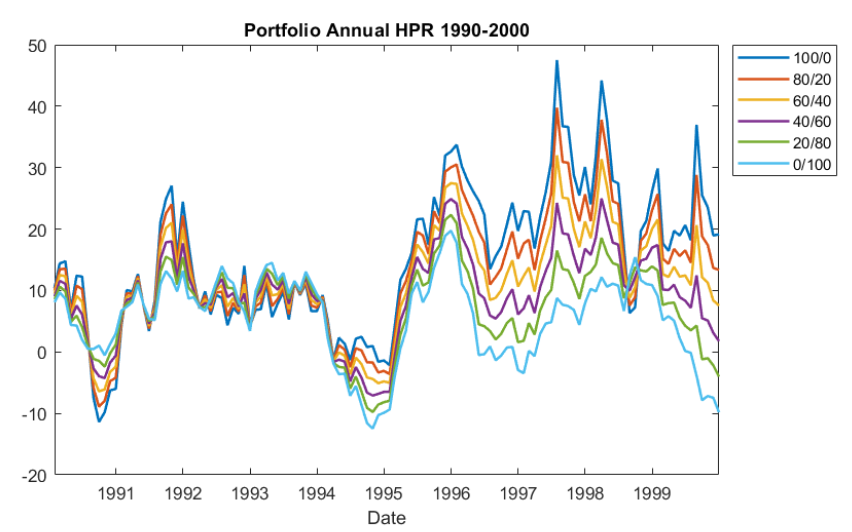

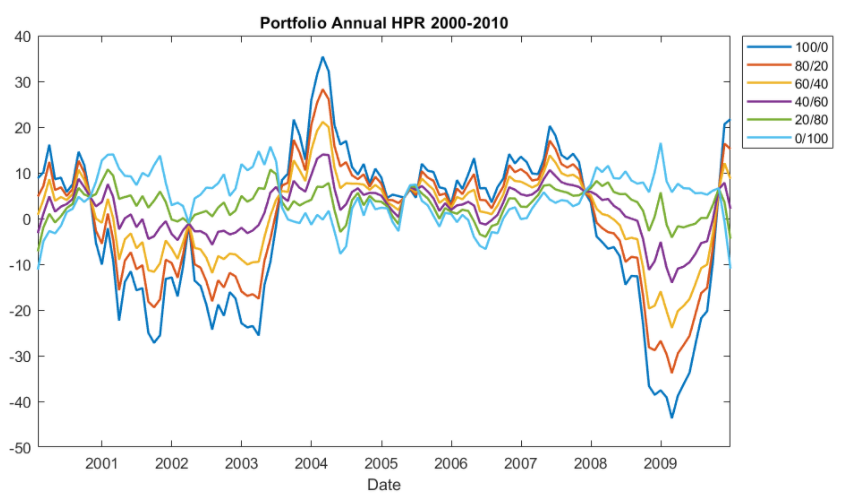

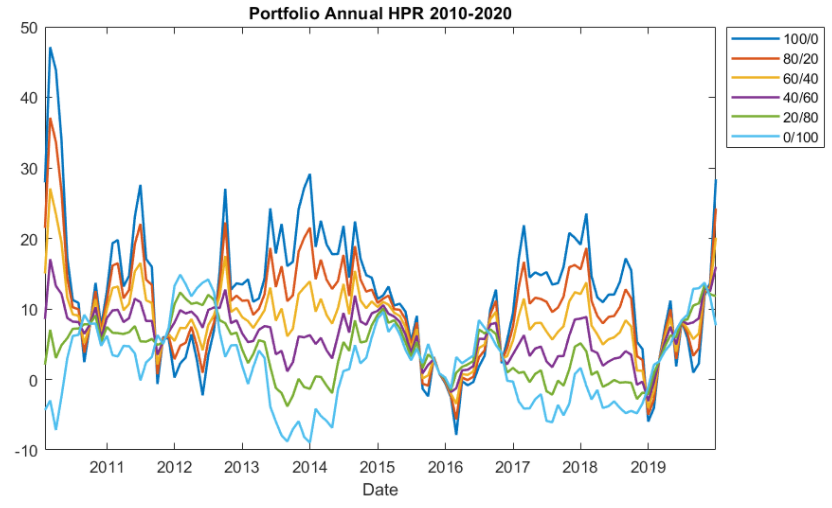

The figures below illustrate the performance of 6 key benchmark portfolios (equity/bond): 100/0, 80/20, 60/40, 40/60, 20/80, 0/100. Plotted are the 1-year holding period returns with distributions received, built from monthly data, over different decades.

A few standard investment wisdoms are evident:

- Returns vary through time

- Equities are “riskier” than bonds

- Optimal risk / return is achieved with some combination of stocks and bonds

Several non-standard findings emerge:

- Stock and Bond returns don’t always move in the opposite direction. Consider the plot of annual returns 1970-1980. Notice the beautiful spread around 1974-1975. While stocks are falling (Duke-blue line) the bond portfolio (Tarheel-blue line) is flat to rising. That’s what we would expect. Fast forward just a few short years to 1977-1978 and you’ll see very little spread between the portfolio returns. Stock and bond returns were essentially identical.

- Bond returns aren’t fixed. Sure, if you hold until maturity you know the yield-to-maturity (YtM) of the bond. However, many of us have fixed income exposure via ETFs and MFs, which opens the door to price risk. Notice the variability of the all-bond portfolio through the 1980s.

- Bonds can lose money. The U.S. didn’t default, but when you have a maturity mismatch, the effective resale price at prevailing market yields could generate a loss on your bond portfolio.

- Bonds can outperform stocks. There is a reason why stocks require a risk premium: they are riskier. That premium pushes AVERAGE returns for stocks above that of bonds. However, for any given holding period, a boring bond can be a winner. Witness the period 2000-2010.

The bottom line is that investors need to know their benchmark.

Doug “Buddy” Amis, CFP®

¹S&P 500 monthly price index data pulled from FRED and combined with historical monthly S&P 500 distributions from Multipl.com

²10-year YtM data is pulled from FRED.