What is IRMAA and why are you taking my money??

Note: This post was originally published July 18, 2022, and has been updated to reflect information current as of December 31, 2023.

A Brief History of Medicare & IRMAA

When you ask a sixty-five-year-old retiree how much they will pay for Medicare each month in 2024 you may get some weird looks, but after that the typical answer is $174.70. While the world deals with averages, financial planning is individual. You might be surprised to learn that the amount people pay for Medicare premiums can vary a lot.

It’s true that $174.70 is the standard amount a person eligible for Medicare due to age will pay for their Part B coverage (doctors and general outpatient medical care) in 2024. Most people pay nothing for Part A (hospital and skilled nursing care), and Part D (prescription drugs) is a recommended but optional addition that is also low- to no-cost. But for single retirees earning over $103,000 (or married filing jointly over $206,000), the costs start to add up quickly. The difference in what you and your actual neighbor pay compared to the “typical” neighbor is due to Income Related Monthly Adjustment Amounts (IRMAAs). You may be looking at your bill and wondering, “What is IRMAA?”

Before getting upset with these surcharges appearing in your healthcare budget today, consider the landscape before Medicare. If we grab our time machine and travel back to President Lyndon B. Johnson’s Administration in the 1960s, we find a world where private insurance was falling short of meeting the needs of elderly Americans. Insurance companies charged astronomical premiums to cover older individuals (which were unaffordable to the majority of seniors on a fixed income), and in some cases they even canceled insurance policies for older individuals with high-risk conditions or diseases. President Johnson’s solution to this crisis was Medicare, a Federal program designed to address a malfunctioning market. The program’s premiums are subsidized by the U.S. taxpayer. The cost to enroll in such a program? Three dollars per month in 1966, or less than thirty dollars in today’s dollars.¹

If we fast forward to the early 2000s, Medicare was still evolving to the behemoth it is today. There was no prescription drug coverage, no Medicare Advantage, no IRMAAs, and less access to preventative screenings until George W. Bush signed into law the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA). Prior to the law going into effect in 2007, the Medicare Part B premium was 75 percent subsidized by the government, with all beneficiaries paying only 25 percent of the real cost of insurance regardless of income. The MMA created the first IRMAA, which reduced the subsidy for higher-income individuals.

How Much Does IRMAA Cost?

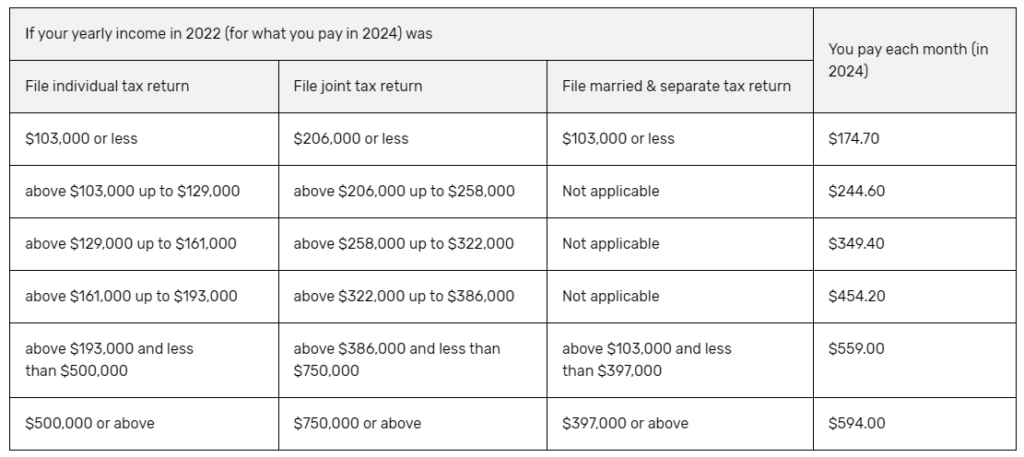

The first IRMAAs and the IRMAAs today are adjusted for inflation, but between 2010 and 2019 they were frozen. The table below shows the income brackets for Medicare IRMAAs in 2024 and how much you will pay for Medicare coverage.

If you do a little math, this table also reveals what the Medicare IRMAA is for 2024, as it reduces the subsidy a little more at each income bracket. The lowest-income bracket receives a subsidy of 75 percent of the cost of coverage, the next bracket receives 65 percent (resulting in an IRMAA of $69.90 on top of the standard amount), then 50 percent ($174.70), 35 percent ($279.5), 20 percent ($384.3), and finally the smallest subsidy of 15 percent (and the highest IRMAA in 2024 of $419.30) goes to the top earners.

Medicare costs and IRMAA for 2023 were very similar, ranging from $164.90 for individuals making $97,000 or less to $560.50 for individuals making more than $500,000. Every year the cost of Medicare and the IRMAA income brackets are recalculated and adjusted as needed. The new IRMAA brackets are released in September of each year.

How to Calculate IRMAA

In order to determine the Medicare Part B and Part D premiums that you pay, Social Security will consider the most recent tax return they have received from the IRS. That’s right, Social Security gets involved here to advise Medicare on your most recently reported income which may not be the most recent income you have earned. Practically, what this means is that in 2024 your Medicare premium is determined by your 2022 tax return, which was due in 2023 (and should have been your most recently filed return as of January 1, 2024 if you’re staying out of trouble). Can you see the potential problem here? Your income two years ago is likely different than it is now.

Let’s do an exercise and read your tax return like you’re looking for an IRMAA. Break out your tax return: look on your Form 1040, find Adjusted Gross Income (AGI) on line 11, find taxable income on line 15, and then find the Modified Adjusted Gross Income (MAGI) on line…wait, it’s not on a line!

Unfortunately, it’s not quite that straightforward. MAGI is not something you can look up; it has to be calculated in context. In this case, Social Security is calculating your MAGI. To calculate MAGI like they do for IRMAAs and Medicare, you can take your AGI and add any tax-exempt interest or foreign-earned income received (typically excluded from AGI).

Unlike tax brackets, which are marginal, IRMAA utilizes a “cliff” style of assessment, meaning if you are just $1 over the cutoff for the next tier of IRMAA, then you will pay the higher amount. You might remember your parents asking you if your friends all jumped off of a cliff, would you do it too? I think we can agree that we want to avoid cliff diving when we can! Each “cliff” does not reflect an increase in the Part B premium but rather a decrease in the available subsidy offered by the federal government. As I mentioned above, retirees today pay either 25 percent (the standard premium of $174.70 per month), 35 percent, 50 percent, 65 percent, 80 percent, or 85 percent ($594.00) of the full cost of the Part B premium ($698.80 per month).

How to Avoid IRMAA

So now that you know the history behind IRMAA and how it is assessed, how can you avoid it? Don’t go off the cliff, and don’t get pushed! If you are blowing out the candles on your sixty-fifth birthday or enrolling in Medicare for the first time, it is very likely that you retired in the last two years. If that is the case, your income may be drastically different this year compared to two years ago. You might be pushed into IRMAAs, but there is relief available if you know about it. Retirement is an example of a life-changing event that qualifies you to apply for an appeal of your IRMAA assessment. Qualifying life-changing events are:

- Marriage

- Divorce/Annulment

- Death of a spouse

- Work stoppage or reduction

- Loss of income-producing property

- Loss of pension

- Employer settlement payment

If you appeal, you will be required to estimate your MAGI, and if accepted, Social Security will determine your revised Part B premium amount with that estimate. You may even qualify for a refund.

If you are an average retiree with Social Security, maybe a pension, and retirement savings accounts like IRAs and 401(k) plans, you may accidentally push your future self off the IRMAA cliff! If you followed the conventional advice of saving into your traditional 401(k) plan or other employer-sponsored plan over your working career, your Required Minimum Distributions (RMDs) may cause a potential tax bomb: not only by bumping you into a higher tax bracket but also by sending you over that IRMAA cliff. This is why it is important to build an income plan not only on an annual basis but also looking further into the future.

Some of you reading at home may simply have too much income to avoid IRMAA altogether. Many of our clients ask: Which checking account would be best for IRMAA? For most people, we recommend paying for IRMAA and Medicare costs from a Health Savings Account (HSA). While you cannot contribute to an HSA once you have started Medicare, any money that you built up in that account ahead of your enrollment can still be used to pay for these healthcare costs tax free.

Approximately 8 percent of Medicare beneficiaries are impacted by IRMAA today. 8 percent may not sound like a lot, but with the number of Medicare enrollees approaching 66 million, 8 percent is over 5.2 million people. While IRMAA cannot always be avoided, it should always be planned and budgeted for. It is important to work with a fiduciary who will help with tax planning on at least an annual basis to manage income, keeping in mind both cash flow needs and also the pitfall that is IRMAA.

Jacob Yocco, CFP®

1. https://www.ssa.gov/history/ssa/lbjmedicare1.html