“Just when I thought I was out, they pull me back in!” – The Godfather 3

Medicare Season is Over Now, Right?

Every year more people become accustomed to the Medicare Annual Enrollment Period (AEP) timeline. By October 1st you learn to expect the commercials, by October 15th you are likely getting phone calls and emails from your insurance agents that it is time to review your policies, and by December 7th, the AEP deadline, you are just about sick of hearing about Medicare. Flash forward to January 1st, and you might be thinking you have finally escaped Medicare until next fall… Not so fast there, Michael Corleone.

Let me introduce you to the Medicare General Enrollment Period and the Medicare Advantage Open Enrollment Period (MAOEP), which both run simultaneously from January 1st – March 31st annually.

The General Enrollment Period is the opportunity for folks who decided not to join Part B when they turned 65 and do not have a Special Enrollment Period (triggered by an event such as losing an employer’s coverage at retirement) to get started on Part B now that they want it. The catch, however, is that even after enrolling, Part B will not start until later in the year on July 1st, and there will likely be a late enrollment penalty. In my time working with Medicare, I have only seen a very small handful of clients need to use the General Enrollment Period to start Part B; it is important to know it is available if you are not on Part B, but once you are fully enrolled in Medicare you do not need to worry about it.

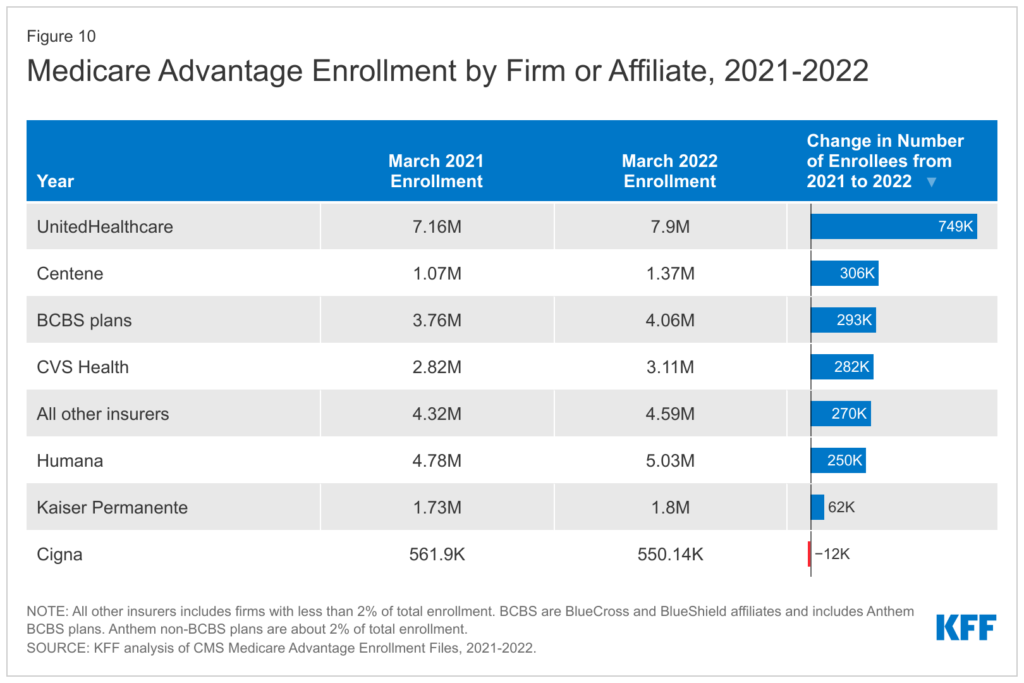

The MAOEP, on the other hand, is available annually to everyone already enrolled in a Medicare Advantage Plan, which Kaiser Family Foundation’s research estimates to be about 48 percent of all Medicare beneficiaries. It is important to note that this is a key difference from the fall Annual Enrollment Period (AEP) window, which is well known for being the primary time to enroll in Medicare Advantage and Prescription Drug Plans. AEP is available to everyone on Medicare, while MAOEP is just for those enrolled in a Medicare Advantage Plan. MAOEP presents two main options to beneficiaries: Firstly, you can use it to enroll in another advantage plan, and secondly, you can use it to switch back to Original Medicare. For those who either forgot to make their switch during AEP or who think that the grass may be greener with Original Medicare, the MAOEP is making you an offer you can’t refuse.

The Offer

Now don’t get me wrong; there is a pretty big difference between the offers Medicare makes and the offers the Godfather makes. Regardless, it is important to take advantage of the opportunities that you are provided. United HealthCare, a major competitor in the Medicare Advantage Plan market, recommends enrollees use their plans early on in the year, before the MAOEP deadline, in order to understand how they work and see if there is anything they do not like about the plan before it is too late to change anything. The MAOEP presents a sort of “get out of jail free card” to beneficiaries who follow that advice.

It is important to realize, though, that once you have used that card then it is gone. Once you have decided to make a change and have enrolled in a new plan, the decision will go into effect the 1st of the following month and stick for the rest of the year. This is another key difference between MAOEP and AEP. During AEP, you can make as many changes as you like and only the final enrollment sticks when the coverage begins the following year. It is important that any decision you make in MAOEP be a well thought out and researched one.

If you are planning to switch to Original Medicare and a supplement, it is especially important to make sure that you are accepted with the supplement plan prior to enrolling in a drug plan. Enrolling in a drug plan during this period serves to “kick you out” of your existing Medicare Advantage Plan, and can be a simple way to cancel that policy – but it is only simple if you have a supplement plan ready to go. Medicare supplement companies ask various health questions to determine if they will accept you, so if you enroll in a drug plan before ensuring you are accepted, then you run the risk of having to pay substantially more to get a company that is more lenient with their underwriting, or worse, not having any health and medical coverage at all.

While it is important every year during AEP to attempt to make the best personal selection of insurance policies for the following year, the MAOEP presents a unique second chance each year when new information comes to light or if you gain a new understanding of the facts. The Godfather may not be one to offer many himself, but rest assured that Medicare is doing precisely that here. I recommend working closely with an experienced broker if you plan on making this particular change in order to ensure a smooth and seamless transition.

Jacob Yocco, CFP®