Teaching your kids the ABCs of financial literacy

Build a Strong Foundation for the Future

Research has shown that most of our money habits are developed while we’re children.

No matter if you have wealth to spare or are pinching every penny, the best thing you can pass on to your kids to set them up for success is money-smarts, not any dollar amount. Giving your kids a sound understanding of personal finances can help them make smart financial decisions now and in the future.

Just like with everything you teach them, there are a lot of ways that parents can influence habits, introducing key concepts as a foundation they can grow from. Certain behavioral principles are at the core of every smart money decision:

- Understanding the concept of ‘future’

- The ability to delay gratification and be patient while saving to afford something

- The ability to avoid impulsive, irreversible decisions

The younger your kid is, the harder these principles are to understand and practice, but you might be surprised at how early you can start.

Is It a “Wanna” or a “Gotta”?

Your preschooler is probably able to tell you their favorite foods, express preferences between clothing choices, and brainstorm play date activities. These are all topics that beg the question of needs vs. wants. Practice describing things as needs and wants as you help them make these decisions.

Between kindergarten and second grade, have them write down different things they would like to do or have that cost money, and then categorize each item as a need or a want. Once you have a working list of things they both need and want, you can ask them to prioritize the list by how much they want each item. Hang the list somewhere they can see it often.

This budgeting exercise can help them visualize the difference between the two and learn to make the distinctions in day-to-day life. Help them understand how much each list item costs, and then develop a savings plan with some SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound). This can be the basis of Kid Budgeting 101.

This or That?

Another useful topic that can be taught early is opportunity cost, and it can help define the concept of the ‘future.’ When you shop with your kids, do they ask you for things they see, maybe a toy or a piece of candy? This is a perfect chance to let them see opportunity cost in action.

- Ask them to think about whether the item they are begging (or asking politely) for is a need or a want.

- Explain that if they get the item now, they will have to delay getting something else from the list you created together earlier. Depending on the cost of the new item, the delay might be very long.

Budgets are for Everyone

After you’ve started having conversations about basic needs and wants, one of the next pieces in building a strong financial foundation is establishing a budget. In Debt.com’s annual budgeting survey, in 2022, 90 percent of respondents agreed that everyone needs a budget. One purpose of budgeting is to help reduce overspending, but it doesn’t stop there. While you may not have started an allowance, you can talk to them about how you divide your money when they see you complete related tasks, such as shopping, paying bills, and donating cash.

By third grade, or when you are ready to introduce some “income”, you can help your kid implement their own budget. A “save, spend, give” system will show different uses of money and can be as simple as labeling three envelopes to act as piggy banks. Every time your kid receives money, whether from their income or a gift, distribute a pre-set percentage to each of the three categories. This system helps reinforce the balance between current needs, future wants, and budgeting enough to make the world a better place.

Show Them the Money!

Around the time your kid starts budgeting or a little later, try to help incentivize good budgeting habits, and plan to discuss the power of compound interest. Consider offering a small “bonus” each time they put money in savings, growing their account without the risk of loss.

After some time, enough money may accumulate that you’ll want to move it into a bank account. Talk to your bank about options for minors; typically these accounts have many restrictions compared to a standard checking or savings account. Some banks have “bucket” features that may help visualize the three categories even when they are in the same account.

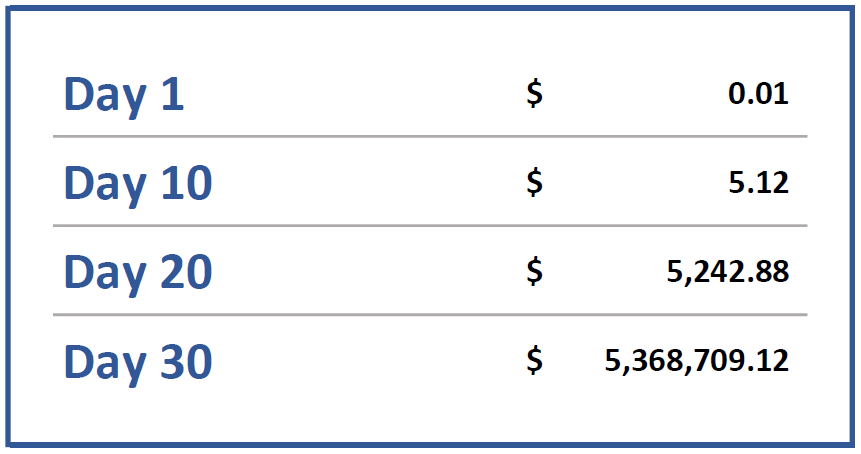

One way to educate them about interest is to ask: would you rather have $1,000,000 or a penny that doubles every day for one month? If they understand how big one million is (and you can help them with that, too), chances are they will select the $1,000,000. This allows you to uncover the powerful trick of compound interest, explaining that the doubling penny option is worth far more.¹ It’s not magic, it’s math!

Eyes on the Prize

Regardless of how good your kid is with money, eventually they will need to prove it with a good credit score, perhaps with the purchase of a car or their first lease. Without credit history, these actions will be more time-consuming, and potentially more expensive or extremely options-limited. Starting a credit history while your kid is still young gives them a big leg up when entering adulthood.

One way to do this is to add them as an authorized user on your own credit card, whether or not you actually allow them to use it. Some companies have no minimum age for this. If you feel comfortable, you could also set up a secured credit card for your pre-teen or teen to accompany their budgeted spending. This allows them to spend only what is on the card, so there are never big balance surprises. Keep a close eye on their spending to make sure that new shiny plastic doesn’t distract them from their goals.

Make sure you are also demonstrating the implications of a credit score. Pull up your own credit score through your bank or on a site like CreditKarma, and walk through the different factors that make up the score. Explore together the total cost of buying a home or car with different interest rates offered based on varying credit scores. This will give perspective on how much it matters to keep credit balances low and maintain a good payment history.

Putting the Pieces Together

Finally, well before they are faced with their first employer-sponsored retirement account, your kid should know some things about investments and risk. Personally, I attribute a lot of my own interest in finance to my father’s insistence that I learn these concepts early by allowing me to manage a small portfolio.

If the idea of potentially frittering away real money makes you queasy, there are other ways to get kids involved with investing. One fun way is to let them play the Stock Market Game, selecting hypothetical stocks to manage a hypothetical portfolio. There are many different websites for this, but the SIFMA Foundation has a great version: https://www.stockmarketgame.org/

A real-world compromise option is to open a Uniform Gifts to Minors Act or Uniform Transfers to Minors Act (UGMA/UTMA) account or a custodian IRA/Roth IRA, accounts in a minor’s name that allow both kids and parents to save money and invest. Parents retain control over the account until the child reaches majority age.

Teaching kids about money is like teaching anything: it takes time and patience. You may have missed these lessons yourself and find the need to brush up now. But if you take the time, the knowledge they learn will stick with them throughout their whole life.

Doug “Buddy” Amis, CFP®

1. Calculation by Cardinal Retirement Planning, Inc.